Market leader

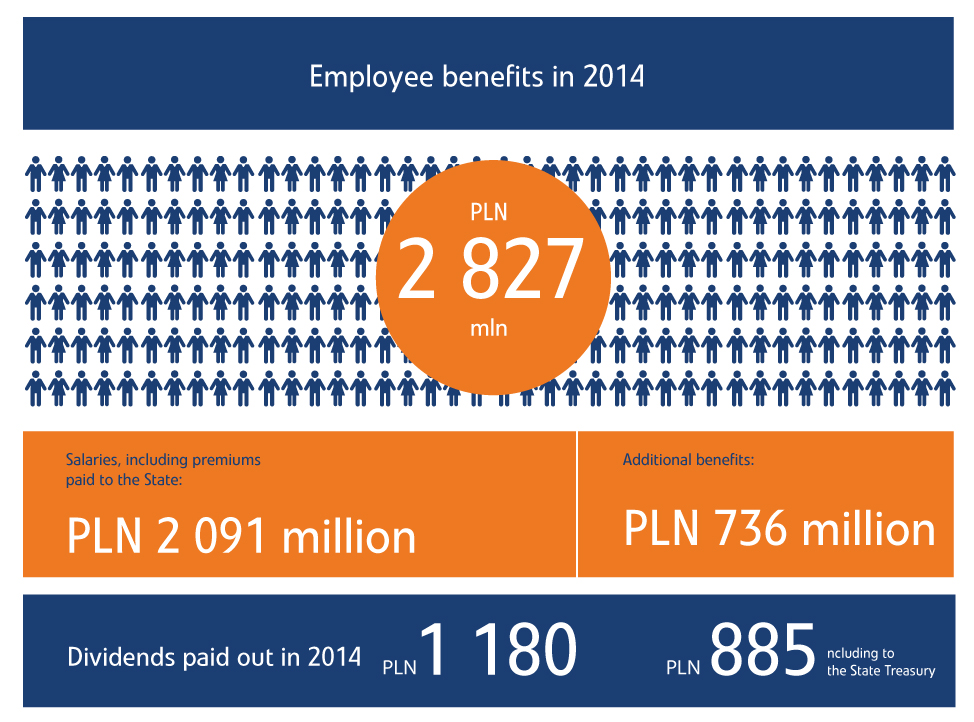

The PGNiG Capital Group is one of the largest enterprises in Poland. We are fully aware that our operations exert a significant and direct impact on the economy, local communities and the environment. The Group employs more than 28,000 people, and it is one of the largest employers in the country.

Our products and services reach 6.8 million customers, including a vast number of private users across the country as well as a large group of industrial plants. PGNiG makes every effort to satisfy its clients' energy needs at competitive prices, without compromising its obligations towards shareholders. In 2014, we paid out PLN 1,180 million in dividends, including PLN 885 million to the State Treasury, our majority shareholder.

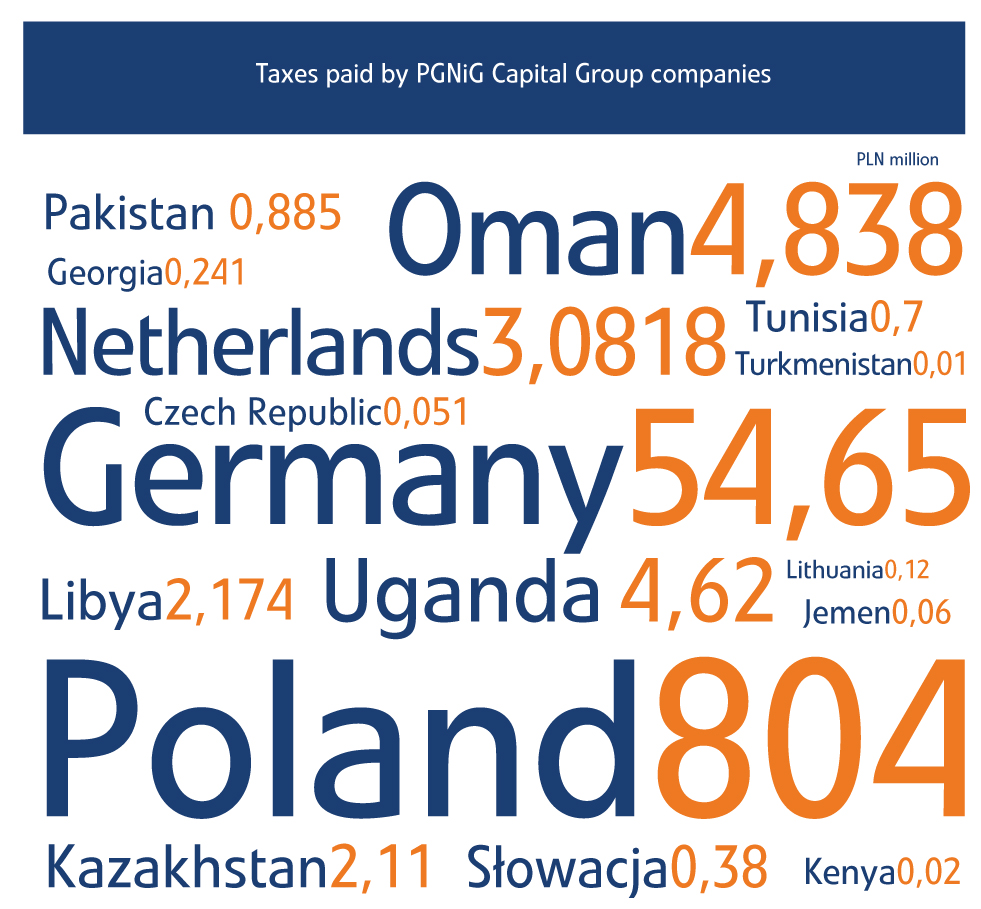

PGNiG Capital Group's operations significantly contribute to the State budget. As a long-standing leader of the Polish natural gas market with an 80% market share, the company paid PLN 804 million in corporate income tax to the central budget in 2014.

According to initial estimates of the Central Statistical Office, Poland's GDP increased by 3.3% in 2014, and the noted growth was 50% higher in comparison with 2013 (1.7%). Economic growth was largely driven by domestic demand which increased by 4.6% from only 0.2% in the preceding year. Consumer spending jumped to 3.0% from the modest level of 1.1% in 2013.

These data build a positive image of the Polish economy in 2014. Poland was one of the most rapidly developing economies in the European Union during that period.

Poland's GDP growth is positively correlated with growing consumption of natural gas, which is directly reflected by PGNiG's satisfactory sales results. The observed increase can be attributed to several factors, including rising demand for gas as a chemical compound in the manufacture of various goods (e.g. plastics, fertilizers), growing household incomes and wealth which leads to the replacement of coal boilers with cleaner and less maintenance-intensive gas boilers, expansion of the gas distribution network, and gradual transition to low-emission energy generation, in particular combined cycle gas turbine plants.

The mission of the PGNiG Capital Group is to create value for its shareholders and employees. In an effort to achieve that goal, in 2014, we have adopted the Long-Term Strategy of the PGNiG Capital Group for 2014-2022. The Group's companies began to implement measures aiming to create a favorable environment for growth on Poland's deregulated gas market.

Last year, the PGNiG Capital Group generated a net profit of PLN 2.8 billion which marks an increase of 47% from 2013. EBITDA reached PLN 6.3 billion, up by 13% from the previous year. Operating profit increased by 22% from 2013 to PLN 3.8 billion. In 2014, the Capital Group also reported a 7% increase in sales revenues which exceeded PLN 34 billion. The Group's satisfactory financial performance can be largely attributed to achievements in the area of exploration and distribution.

In 2014, the price of PGNiG shares was characterized by significant fluctuations which exceeded the changes in WIG20 and WIG-Paliwa indices of which the Group is a part. The fluctuations in PGNiG stock prices ranged from -21% to +1% relative to market close levels at the end of 2013, and from -7% to +5% in the WIG20 index which is generally more stable. The main reasons for the noted changes were:

- uncertainty related to the Russian-Ukrainian conflict and its implications for the energy market,

- deregulation of the Polish gas market,

- sharp decrease in crude oil prices beginning in August 2014.

The price per PGNiG share ranged from PLN 4.17 to 5.33 during the year.

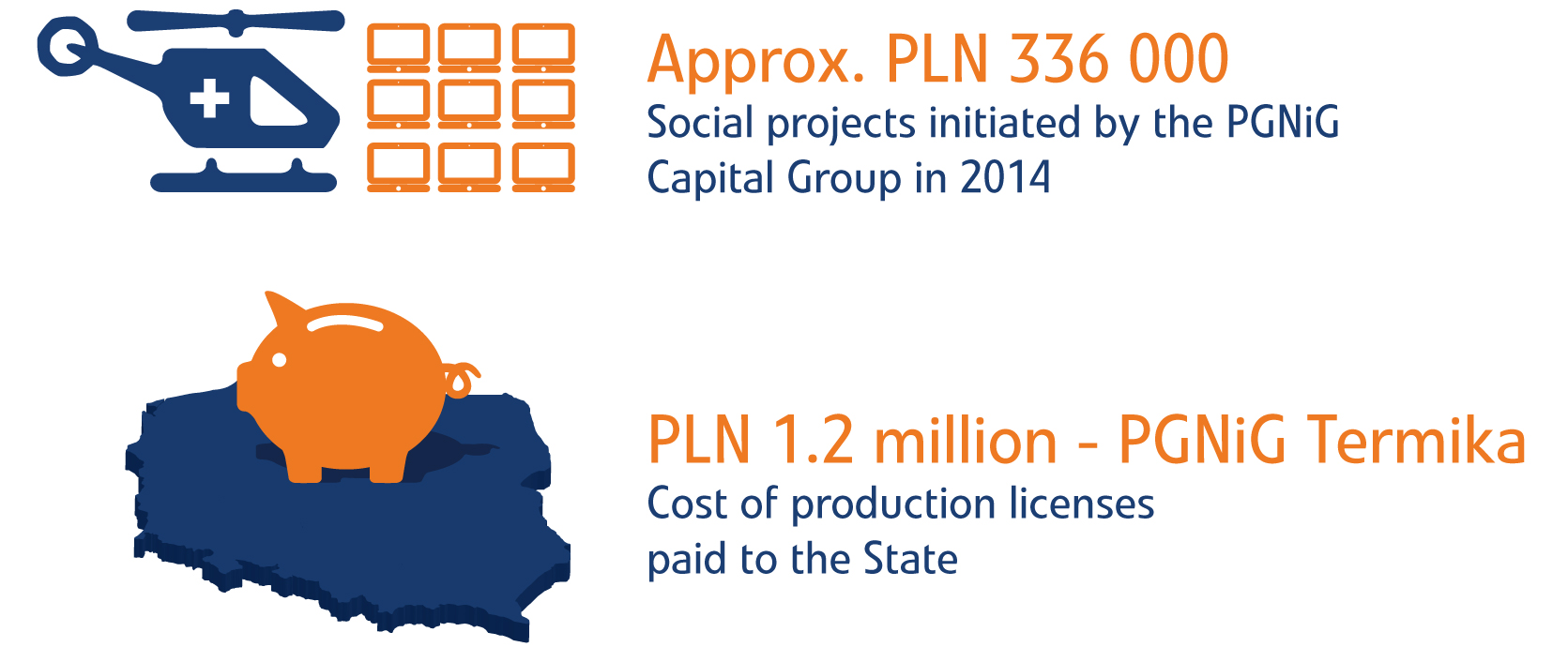

A revamped business strategy supported the determination of new directions for growth. One of them are investments in heat generation assets which are highly valued by the Group as well as potential sellers. The PGNiG Capital Group has many years of experience in asset management on regulated markets, and such assets are a stable source of income with a known level of risk. Nearly 70% of heat distribution networks are still owned by local governments, but the required repairs and maintenance services are very costly and often cannot be financed from municipal budgets. As a leading player on the power market, the Capital Group has the means to participate in investment projects to renovate outdated heat distribution systems and bring them up to the latest environmental protection standards. PGNiG is a reliable and widely recognized business which operates across the country and has extensive experience in working with local partners. We will use the synergies, potential and vast resources of the entire Capital Group, including Polska Spółka Gazownictwa and PGNiG Termika.

The Management by Objectives program, which has been implemented in the Group in 2009 to translate strategic goals into operating and financial decisions at all levels of management, will assist the Group in achieving its strategic goals. PGNiG is a very large and diverse organization, and in order to effectively manage its operations, the Group has to comply with the provisions of major legal documents, including Poland's Energy Policy, EU directives, the Energy Law, the Act on the special hydrocarbon tax, and the 2030 framework for climate and energy policies.

Due to the specific nature of the market segments in which PGNiG Group companies operate, our subsidiaries strictly observe legal regulations and restrictions in all countries where they are present. They comply with the requirements that are imposed locally on businesses in a given industry. For example, Geofizyka Kraków and Geofizyka Toruń have to acquire the relevant licenses and permissions for the acquisition of seismic data.

In Poland, the Geological and Mining Law is the key legal act regulating hydrocarbon exploration and mining operations.

Detailed information about the regulatory environment of the PGNiG Capital Group in various market segments is available in the Annual Report of the PGNiG Capital Group for 2014:

The PGNiG Capital Group enjoys a leading position in most segments of the Polish gas market. The Group's major operations are crude oil and natural gas exploration, fuel storage, sale and distribution of natural gas. Natural gas and oil deposits are exploited mainly in Poland and on the Norwegian Continental Shelf, and they provide the Group with a competitive advantage on a deregulated market. In the area of trade and storage, we sell imported and domestically produced gas, and we provide our customers with regular supplies also in periods of increased demand for gas. Our distribution companies supply gas to end users and the distribution network, and they upgrade and expand gas transmission systems. In 2012, the Group expanded its range of operations to include the generation and sale of heat and electricity.

The PGNiG Capital Group conducts operations in 4 key segments: Exploration and Production, Trade and Storage, Distribution, and Generation.

Exploration and Production

The key operations in the Exploration and Production segment are oil and gas exploration and processing of crude products. This segment covers the entire process of searching for and exploiting natural gas and oil deposits, beginning from geological surveys, geophysical tests and drilling, to deposit management and exploration. The relevant operations are carried out independently as well as with partners under joint operation agreements.

In Poland, natural gas and crude oil reserves are explored by PGNiG branches in Zielona Góra and Sanok. Foreign deposits are managed by the Operating Branch in Pakistan, PGNiG Upstream International in Norway, and Polish Oil and Gas Company Libya B.V. Due to the current political situation in Libya, we are unable to proceed with drilling works and seismic surveys in the area covered by the license, and the company has not fulfilled all of its obligations under the license. Exalo Drilling with its subsidiaries, Oil Tech International F.Z.E and Poltava Services LLC, and PGNiG Technologie SA, perform specialist services on foreign markets. Research services are provided by Geofizyka Kraków SA, Geofizyka Toruń SA and the Central Measurement and Testing Laboratory, a branch of PGNiG SA.

Trade and Storage

The Trade and Storage segment sells natural gas which is both imported and extracted from domestic deposits. In 2014, gas was supplied to end users by PGNiG SA and its retail business PGNiG Obrót Detaliczny Sp. z o.o. (OD). PGNiG SA OOH Wholesale Trade Branch (OOH) was responsible for supplying natural gas, crude oil, condensate, electricity and related products to industrial customers. PGNiG Sales & Trading (PST) is the Capital Group's energy trading hub which is responsible for optimizing the portfolio in Western Europe.

Operator Systemu Magazynowania Sp. z o. o. (OSM), PGNiG's storage system operator, controls the working capacity of PGNiG's storage facilities.

Distribution

The Distribution segment is responsible for transporting methane-rich and nitrogen-rich natural gas as well as limited quantities of propane, butane and coal gas via the distribution network. The segment upgrades and expands gas pipelines and connects new clients to the existing and expanded network. Natural gas is distributed by Polska Spółka Gazownictwa Sp. z o.o. (PSG).

Generation

The major company in the Generation segment is PGNiG TERMIKA SA which generates, distributes and sells heat and electricity. The company is also the Capital Group's competency center for heat and electricity generation as well as electrical and thermal engineering projects. The segment is also responsible for large electrical engineering projects that rely on natural gas as fuel.

Supervision

The PGNiG SA Head Office is at the top of the organizational hierarchy of the PGNiG Capital Group. The Head Office oversees the Group's statutory operations and directly supervises the branches in Zielona Góra, Sanok and Odolanów, the Central Measurement and Testing Laboratory, Borehole Mining Rescue Station, Wholesale Trade Branch (OOH) and the Geology and Exploration Branch. The Head Office supervises mining and exploration operations, and it monitors the operations and performance of all PGNiG Capital Group companies.

Support services

Several members of the PGNiG Capital Group provide support services for the Group's core business. Geofizyka Kraków, Geofizyka Toruń and the Central Measurement and Testing Laboratory are research companies that perform surveys and provide analytical services. Exalo Drilling, PGNiG Technologie, PGNiG Serwis and Gazoprojekt provide the Group with support in the area of technology, design, construction, start-up and maintenance.

Click on the name of the Company or Branch for additional information about its business profile, products, services, markets and clients.

List of Companies and branches:

- BSiPG GAZOPROJEKT SA

- Geofizyka Kraków SA,

- Geofizyka Toruń SA,

- Geovita SA

- Exalo Drilling SA,

- PGNiG Upstream International AS

- Polish Oil and Gas Company Libya BV

- Operator Systemu Magazynowania Sp. z o.o.

- PGNiG Obrót Detaliczny Sp. z o.o.

- PGNiG Sales and Trading GMBH

- PGNiG Serwis Sp. z o.o.

- Polska Spółka Gazownictwa Sp. z o.o.

- PGNiG TERMIKA SA

- PGNiG TECHNOLOGIE SA

- PGNiG SA Central Measurement and Testing Laboratory

- PGNiG SA Branch in Odolanow

- PGNiG SA OOH Wholesale Trade Branch

- PGNiG SA Branch in Sanok

- PGNiG SA Branch in Zielona Góra

As the leading supplier of natural gas in Poland, PGNiG makes every effort to implement modern solutions and effective management standards throughout the entire value chain in the gas segment and to consolidate its assets in fuel and power industries. The PGNiG Capital Group brings together companies with diverse operating profiles at different levels of the value chain. Every PGNiG company operating in one of the four key segments (Exploration and Production, Trade and Storage, Distribution, and Generation) and its subsidiaries develop their own supply policies. As the result, the PGNiG Capital Groups works with around 60,000 suppliers.

The broad range of operations carried out by PGNiG companies contributes to the diversity of the supply chain. PGNiG works mostly with Polish suppliers, but also with foreign suppliers from various countries around the globe, including the EU, USA, Singapore, China, Japan, Canada, Russia and Qatar.