Trade and Storage

This segment’s principal activity is trade in natural gas. Gas sold by the segment is mainly imported, but also domestically produced.

The PGNiG Group is the largest supplier of natural gas in Poland. According to the Energy Regulatory Office, PGNiG’s share in total sales of natural gas in 2013 was 94.4%. In 2014 natural gas was supplied to customers mostly by two companies of the Group: PGNiG and its subsidiary PGNiG Obrót Detaliczny Sp. z o.o. (PGNIG Retail), which commenced operations on 1 August 2014. Thus, the company has become the largest retail supplier of natural gas, while PGNiG has maintained its leading position on the wholesale market.

The sale of natural gas through the distribution and transmission network is regulated by the Polish Energy Law, and gas prices are determined based on tariffs approved by the President of the Energy Regulatory Office (URE). An exception is for natural gas sold at the Polish Power Exchange (PPE). The segment also trades in electricity, certificates of origin for electricity, and CO2 emission allowances. The segment operates seven underground gas storage facilities (Brzeźnica, Husów, Mogilno, Strachocina, Swarzów, Wierzchowice and Kosakowo).

Analysis of financial performance in 2014

An improvement in efficiency was recorded in the Trade and Storage segment, where operating profit was up PLN 591m year on year, to PLN 583m. The segment’s performance in 2014 was driven by the average cost of gas fuel procurement being in a more favourable relation to selling prices than in the previous year, chiefly as a result of lower volumes of gas fuel sold.

Year on year, revenue was up by PLN 3,166m (12%), driven principally by higher revenue from gas traded on the Polish Power Exchange, where PGNiG sold 3.7 bn m3 of gas in 2014 (2013: 0.1 bn m3). The segment’s operating expenses were up by PLN 2,575m (10%) on the back of higher expenses attributable to gas fuel purchased on the Polish Power Exchange by PGNiG Retail. PGNiG’s sales and PGNiG Retail’s purchases made on the Polish Power Exchange are not subject to elimination from the consolidated financial statements.

A decline in gas volumes sold to customers was the key factor affecting the Trade and Storage segment’s performance. In 2014 the segment’s gas sales volumes, excluding volumes traded on commodity exchanges, was 13.5 bn m3. having fallen from 15.1 bn m3 (11%) in the previous year. The decrease was caused by the average temperatures being higher by 0.9oC than the year before. In addition, as a result of OOO Gazprom Export’s order reductions, imports from countries east of Poland in 2014 were down to 8.1 bn m3 (by 7%). The segment’s improved performance was also associated with lower gas procurement costs, which was a result of the four-quarter nine-month average price of Brent, expressed in PLN, being lower by 2%, along with lower average annual prices of gas fuel on the TTF (down by 18%) compared with the year before. As at 31 December 2014, the Group held ca. 2.1 bn m3 of gas in underground storage – approximately 1.4% less than at the end of 2013.

| TRADE AND STORAGE PLNm |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| Segment’s total revenue | 28,825 | 25,659 | 23,713 | 20,045 | 19,080 | 17,371 |

| Segment’s total expenses | -28,242 | -25,667 | -23,388 | -20,229 | -18,264 | -17,421 |

| EBIT | 583 | -8 | 325 | -184 | 815 | -50 |

| Segment’s assets | 18,299 | 17,344 | 18,650 | 12,117 | 10,447 | 10,201 |

| Segment’s liabilities | 4,873 | 4,634 | 3,937 | 2,774 | 3,536 | 2,921 |

Segment’s figures

| NATURAL GAS SALES, PGNiG Group* m m3 |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| HIGH-METHANE GAS (E) | 17,261 | 15,006 | 13,756 | 13,167 | 13,099 | 11,921 |

| including PGNiG and PGNiG Retail sales outside PGNiG Group | 15,501 | 13,623 | 13,433 | 13,167 | 13,099 | 11,921 |

| including PST sales outside PGNiG Group | 1,760 | 1,383 | 324 | - | - | - |

| NITROGEN-RICH GAS (Ls/Lw as E equiv.) | 1,342 | 1,202 | 1,156 | 1,111 | 1,137 | 1,234 |

| including PGNiG and PGNiG Retail sales outside PGNiG Group | 1,285 | 1,177 | 1,156 | 1,111 | 1,137 | 1,234 |

| including sales in Pakistan | 57 | 25 | - | - | - | - |

| TOTAL (measured as E equivalent) | 18,603 | 16,208 | 14,912 | 14,278 | 14,236 | 13,155 |

* Measured as high-methane gas equivalent, including direct sales from fields (Exploration and Production segment), after consolidation eliminations; volumes of PGNiG sales through the Polish Power Exchange (PPE) and of PGNiG Retail sales were not eliminated due to the anonymity of trade on PPE.

Trade operations in Poland in 2014

Regulatory environment

The regulatory environment of the Trade and Storage segment is formed by a combination of national and EU laws. The most important Polish laws governing the PGNiG Group’s operations in the trade and storage area include:

- the Energy Law,

- the Council of Ministers’ Regulation of 24 October 2000 on the minimum level of diversification of foreign sources of gas supplies,

- the Regulation of the Minister of the Economy of 28 June 2013 on detailed rules for determining and calculating gas fuel tariffs and on settlements in gas fuel trading,

- the Energy Efficiency Act,

- the Act on Stocks of Crude Oil, Petroleum Products and Natural Gas, and on the Rules to be Followed in the Event of a Threat to National Fuel Security or Disruptions on the Petroleum Market,

- Regulation (EU) No 994/2010 concerning measures to safeguard security of gas supply,

- Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 25 2011 on wholesale energy market integrity and transparency.

The Polish Energy Law, along with secondary legislation, defines the basic rules for trade in natural gas, grant of licences and determination of energy tariffs. Its content takes into account the legal acts included in the Third Energy Package, in particular Directive 2009/73/EC of 13 July 2009 concerning common rules for the internal market in natural gas, and Regulation No 715/2009 on conditions for access to the natural gas transmission networks. Pursuant to the provisions of the Polish Energy Law, a licence issued by the President of the Energy Regulatory Office is required for trading in gas fuels and electricity. PGNiG conducts its trade activities under the following licences:

- licence to trade in gas fuels,

- licence to trade in natural gas with foreign partners,

- licence to trade in liquid fuels and

- licence to trade in electricity.

PGNiG Retail holds:

- licence to trade in gas fuels and

- licence to trade in electricity.

On 11 September 2013 an Act Amending the Energy Law (referred to as the ‘Mini Three-Pack’) took effect. Under the amendment, an energy company trading in gas fuels is obliged to sell a part of its high-methane gas volume introduced to the transmission network in a given year on the exchange market (the exchange sale requirement). Consequently, PGNiG, being the only entity actually bound by the obligation, is required to sell on the exchange market at least 30% (in the period from the amendment’s effective date to the end of 2013), 40% (in 2014), and 55% (as of 2015) of the high-methane gas volume introduced to the transmission network in a given year. In the period directly following the effective date of the requirement, the demand for gas offered by PGNiG on the power exchange was lower than the supply, which meant that the Company was not able to fulfil its statutory obligation. In those circumstances, on 26 June 2014 the Energy Law was amended again by introducing the rule of general succession of agreements. Following its effective date, on 1 August 2014 PGNiG Retail launched its operations consisting in acquiring gas on the Polish Power Exchange to resell it to retail customers. Since the launch of PGNiG Retail’s operations, a material increase in exchange gas sales has been observed. A failure to meet the obligation to sell gas on the exchange market in the amounts specified by the Energy Law exposes the Company to a major risk of a fine. Such a fine would be imposed by the President of the Energy Regulatory Office in an amount of up to 15% of revenue from the licensed operations in gas fuel trading. The initiatives undertaken by the Company allow us to conclude with a high degree of probability that, despite the increase of the statutory obligation from 40% to 55% in 2015, the obligation will be met.

Issues relating to the country’s fuel security are regulated under Regulation (EU) No 994/2010 of 20 October 2010 concerning measures to safeguard the security of gas supply, and under the Act on Stocks of Crude Oil, Petroleum Products and Natural Gas, and on the Rules to be Followed in the Event of a Threat to National Fuel Security or Disruptions on the Petroleum Market. The Act defines the rules for creating, maintaining and financing stocks of natural gas by energy companies.

From PGNiG’s perspective, another important document is the Energy Efficiency Act of 15 April 2011, enacted to implement Directive 2006/32/EC on energy end-use efficiency and energy services. It establishes a national target for end-use energy savings and introduces a system of energy efficiency certificates (referred to as white certificates) as a means to achieve it. PGNiG and PGNiG Retail, as trading companies, are obliged to purchase and redeem energy efficiency certificates or else pay the buy-out price.

Risks

Tariff calculation

The dependence of the PGNiG Group’s revenue on tariffs approved by the President of the Energy Regulatory Office is a key factor affecting the Group’s regulated business. Tariffs are crucial to the Company’s ability to generate revenue that would cover its reasonable costs and deliver a return on the capital employed. Currently, a significant portion of that revenue depends on the selling prices of gas fuel, which − except to the extent that the gas is sold through the Polish Power Exchange − are regulated prices. The tariff determination rules are defined in the regulations issued under the Energy Law, including primarily the Tariff Regulation. The tariff determination methodology is based on planned volumes. Inaccurate estimates of customer demand for gas (affecting the accuracy of projected purchase and supply volumes), changes in imported gas prices, which cannot be accurately projected, as well as unpredictable fluctuations in currency exchange rates (ultimately affecting the cost of gas imports) may have an adverse effect on the financial performance of the Group.

Purchase prices of imported gas

Prices of imported gas are denominated in USD or EUR, and are based on indexation formulae reflecting the prices of petroleum products and/or gas on the liquid market of Western Europe. Accordingly, changes in foreign exchange rates or prices of petroleum products and gas materially affect the cost of imported gas. Any precise forecast of changes in natural gas prices carries a high risk of error. With respect to a part of volumes sold at tariff prices, the approved prices can be legally adjusted during the tariff term. However, there is a risk that an increase in the price of imported gas may not be fully passed on to customers, or that changes in gas sale prices may lag behind changes in gas import prices. Further, if contract prices of imported gas drop materially, the President of the Energy Regulatory Office has the right to call on the company to adjust its tariff prices accordingly, which materially limits the room for a margin increase in the segment.

In the event of exchange sale, which, given the statutory obligations under the Energy Law, affects a material part of imported volumes, there is a risk of a negative decorrelation between the prices quoted on the Polish Power Exchange and the prices calculated in accordance with the formulae stipulated in import contracts. If this risk materialises, it may lead to the need to sell gas at prices lower than the acquisition cost, which in turn will adversely affect the company’s financial performance.

Take-or-pay import contracts

In 2014 PGNiG was a party to four long-term take-or-pay contracts for gas fuel deliveries to Poland. The most important of these are the contracts with OOO Gazprom Export and Qatar Liquefied Gas Company Limited (3) (Qatargas).

On 9 December 2014, PGNiG and Qatargas executed a supplementary agreement to the long-term contract for the sale of liquefied natural gas (LNG) of 29 June 2009. Under the supplementary agreement, the parties altered the terms on which the contract is to be performed throughout 2015. In 2015 Qatargas will place the volumes defined under the long-term contract on other markets, leveraging its position of a leading global LNG producer and supplier. PGNiG will cover any difference between the LNG price specified in the long-term contract and the market price obtained by Qatargas. Should the price be lower than PGNiG finds satisfactory, any unsold LNG supplies will be shifted to subsequent years of the contract.

Obligation to diversify imported gas supplies

The Council of Ministers’ Regulation of 24 October 2000 on the minimum level of diversification of foreign sources of gas supplies prescribes the maximum share of gas imported from a single country in total gas imports in a given year. Currently (2015−2018), the share must not exceed 59%.

For a failure to abide by the obligation to diversify supplies of imported gas in 2007–2008, the President of the Energy Regulatory Office fined the Company PLN 2m (subsequently reduced to PLN 1.5m by the Polish Court of Competition and Consumer Protection, and, following the Company’s appeal, further reduced to PLN 0.5m by the Court of Appeals in Warsaw). PGNiG disagrees with the interpretation of the Regulation’s provisions adopted by the President of the Energy Regulatory Office and both courts. Similar administrative proceedings were instituted by the President of the Energy Regulatory Office concerning PGNiG’s failure to comply with the obligation to diversify supplies of imported gas in 2009, 2010 and 2011. The conclusion of the proceedings concerning the years 2009, 2010, 2011 and 2012 depends upon the conclusion of the proceedings concerning the years 2007 and 2008, pending before courts of general jurisdiction.

If the Regulation is not amended, the President of the Energy Regulatory Office may in continue to impose fines on the Company for failing to comply with the diversification requirement until gas starts to be supplied from other sources (e.g. through the LNG terminal).

Competition in gas sale

PGNiG remains the largest supplier of natural gas in Poland. However, the upcoming gas market deregulation is bound to trigger major changes in the market itself and the related legal framework. In 2012 trade in natural gas on the Polish Power Exchange (PPE) commenced. In 2014, after the spin-off of PGNiG Retail, high liquidity on the PPE gas market was observed, driven also by the activity of entities from outside the PGNiG Group.

An important development promoting competition on the gas market was the launch, as of 1 April 2014, of the physical reverse flow to Poland from sources west of our country, through the Mallnow entry point. Under the reverse flow service, provided on a continuous basis, it is possible to import 2.3 bn m3 of natural gas. On 1 January 2015 the technical capacity for continuous gas imports through the Mallnow entry point was further increased to 5.5 bn m3.

In 2014 no material changes occurred connected with the liberalisation of gas prices for customers. According to earlier announcements by the President of the Energy Regulatory Office, the liberalisation will be a phased process, with gas prices for large industrial customers to be liberalised first.

Increase in the volume of mandatory stocks

The obligation to maintain mandatory stocks of natural gas is stipulated in Article 24 of the Act on Mandatory Stocks. Pursuant to the Act, an energy company engaged in the business of importing natural gas for its resale to customers is required to maintain mandatory stocks of gas in an amount equal to at least the 30-day average daily gas imports into the Republic of Poland. It is worth noting that the amount has been steadily increased over the past several years (from 11 days until October 2009, to 15 days until October 2010, 20 days until October 2012, to the current 30 days, in effect since 1 October 2012). The obligation to create and maintain mandatory stocks is not binding on enterprises importing less than 100 m m3 of gas and serving up to 100,000 customers. While recently the volume of mandatory stocks has been falling in the wake of PGNiG’s reducing gas imports to Poland, the obligation to meet the statutory requirement to maintain mandatory stocks continues to expose PGNiG to numerous risks, including balancing and technological risks, and jeopardises the performance of its contract obligations.

The balancing risk is mainly connected with the inability to cover peak demand for natural gas in autumn and winter if low air temperatures persist. As a result, mandatory stocks significantly constrain the commercial use of the facility’s storage capacity and deliverability. This is primarily connected with the risk of being unable to ensure uninterrupted supplies of gas to end users. The technological risk is connected with the adverse effect of maintaining mandatory stocks on the operating parameters of underground gas storage facilities, which, in the long run, may cause gas migration to sections with worse permeability and porosity, and, consequently, reduce withdrawal capacity. Ultimately, it may cause significant difficulties and drive up costs.

In relation to that last risk, it is probable that PGNiG may not be able to meet its contractual obligations concerning offtake of imported gas if the gas volumes in storage are high at the beginning of summer due to the maintenance of mandatory stocks.

Gas imports

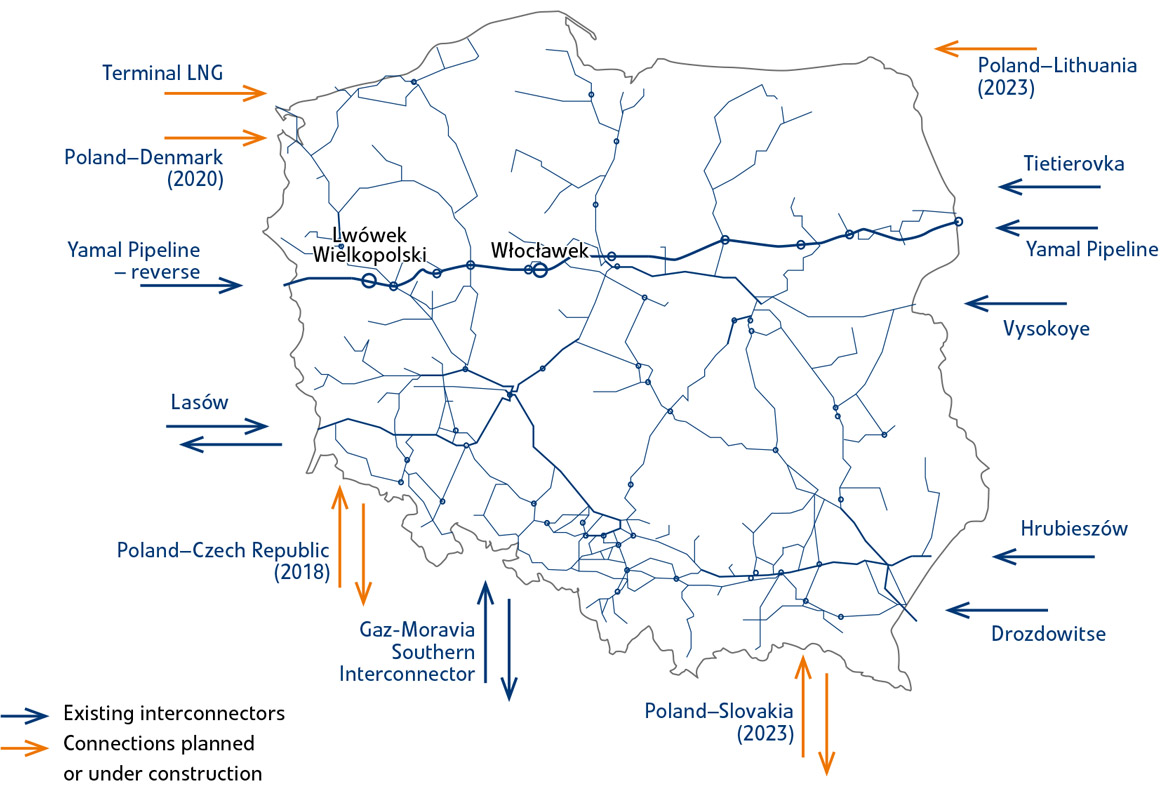

PGNiG is Poland’s largest natural gas importer. Gas is imported primarily from countries east of Poland, as well as from Germany and the Czech Republic. The existing gas infrastructure makes it possible to import natural gas from the following directions:

- East – through cross-border connections in Drozdovitse and Zosin (on the Polish-Ukrainian border), Kondratki, Vysokoye and Teterovka (on the Polish-Belarusian border),

- West – through the cross-border connection in Lasów and using the virtual reverse flow service on the Yamal pipeline,

- South – through the cross-border connection in Branice or, alternatively, in Głuchołazy, and an interconnector pipeline in the Cieszyn area connecting the gas systems of Poland and the Czech Republic.

In 2014 the volume of PGNiG’s imports to Poland reached approximately 9.7 bn m3 of high-methane gas, including:

- 8.1 bn m3 (83.48%) - from OOO Gazprom Export,

- 0.3 bn m3 (3.35%) - from Verbundnetz Gas AG (VNG),

- 0.2 bn m3 (1.75%) - from Vitol SA,

- 1.1 bn m3 (11.43%) - from PGNiG Sales & Trading.

The volume of gas received under the Yamal contract in 2014 was lower than in previous years, which resulted from reduced supplies from sources east of Poland from September until the end of the year. Nonetheless, PGNiG complied with all contractual obligations.

In 2014, PGNiG continued to use the virtual reverse flow on the Yamal gas pipeline.

On 1 January 2015 OGP Gaz-System SA added new technical capacities for importing gas to Poland from across its western border using the Yamal gas pipeline. This became possible as a result of extending the Włocławek entry point. At present, gas may be imported to Poland through the Mallnow-reverse point on a continuous basis at the rate of up to 5.5 bn m3 per annum. The extra transmission capacity was allocated to customers in auctions for quarterly products, which were held in December 2014.

In addition, the transmission capacity at the Mallnow-reverse point is offered on an interruptible basis, which makes it possible to import an additional 2.7 bn m3 of gas per annum if the Yamal gas pipeline is delivering gas to Germany.

The system connections (the Lasów terminal and the connection with the Czech Republic, near Cieszyn, commissioned in 2011) play a very important role in ensuring Poland’s energy security, and may also be used for potential emergency supplies. Further, the connections support free trade flows between EU countries, fostering greater economic integration of member states.

In addition, Polskie LNG SA (a wholly-owned company of OGP Gaz-System SA) is implementing a project to construct the LNG terminal in Świnoujście. In the initial phase, the terminal’s capacity will amount to 5 billion cubic metres of gas.

Imports of natural gas to Poland in 2009-2014 (bn m3)

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

|---|---|---|---|---|---|---|

| Total | 9.70 | 10.85 | 11.00 | 10.92 | 10.06 | 9.13 |

| Sources east of Poland | 8.10 | 8.73 | 9.02 | 9.34 | 9.03 | 8.14 |

| Sources west of Poland | 1.22 | 1.56 | 1.42 | 1.37 | 1.03 | 0.99 |

| Sources south of Poland | 0.38 | 0.56 | 0.56 | 0.21 | - | - |

In 2014 PGNiG’s share in total gas imports to Poland was 80%, down 6 pp on the year before. Taking into account Poland’s gas exports (mainly through Hermanowice), PGNiG’s share in net gas imports in 2014 was 89%, down by 6% relative to 2013. The primary reasons for PGNiG’s lower share in gas imports included reduced sales to end users, the termination of the contract for gas supplies through Cieszyn, executed with Vitol SA, and higher transmission capacity from sources west of Poland, which enabled other market participants to import gas. The largest increase in the share of gas imports to Poland was recorded at the Kondratki and Lasów points, while the largest decline was seen at Cieszyn and Teterovka.

Schematic map of the Polish transmission system entry points

Capacity for natural gas imports to Poland available in 2014

| Total transmission capacity in 2014 (PN) | ||||||||||||

| LNG Terminal in Świnoujście |

Mallnow | PWP | Gubin | Lasów | Branice | Cieszyn | Drozdovitse | Vysokoye | Kondratki | Teterovka | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

available on a continuous basis |

mcm/d | 13.70 | 6.30 | 14.40 | 0.05 | 4.32 | 0.004 | 2.51 | 12.00 | 15.00 | 91.86 | 0.65 |

| kWh/h | 6,326,145 | 2,917,792 | 6,647,337 | 22,420 | 2,007,000 | 1,803 | 1,167,920 | 5,650,000 | 7,043,750 | 42,677,169 | 304,290 | |

|

available on an interruptible basis |

mcm/d | - | 14.90 | 14.90 | 0.05 | 4.32 | 0.004 | 2.51 | 15.81 | 15.16 | 91.86 | 0.65 |

| kWh/h | - | 6,868,919 | 6,868,919 | 22,420 | 2,007,000 | 1,803 | 1,167,920 | 7,345,000 | 7,043,750 | 42,677,169 | 304,290 | |

The planned growth in import and export capacity at the border of the Polish transmission system

(based on ‘Operator Gazociągów Przesyłowych GAZ-SYSTEM SA’s Development Plan for 2014-2023 for satisfying the current and future gas fuel demand’ of 4 April 2014 and information available at OGP Gaz-System SA’s website).

OGP Gaz-System SA is extending the Polish gas transmission system as part of the North-South Corridor project. As part of the project, new sections of the transmission system will be added in western, southern and eastern Poland. The European Commission has classified the project as a Project of Common Interest. Part of the work has already been completed, while other stages are still under preparation.

Interconnection projects implemented in 2014:

- LNG terminal in Świnoujście. The LNG regasification terminal is a strategic investment project implemented by Polskie LNG SA (a wholly-owned company of OGP Gaz-System SA). In the initial phase (from 2015), the terminal’s annual capacity will amount to 5 bn m3 of gas. Apart from ensuring new sources of gas supplies to Poland, in the future the LNG terminal may be a potential source of supplies to Central Europe, Lithuania and other Baltic states. The terminal in Świnoujście is an element of the North-South Corridor, whose other end is a terminal planned in Croatia.

- Mallnow-reverse On 1 April 2014 the physical reverse flow was initiated from sources west of Poland through the Mallnow entry point. As part of the reverse flow transmission service, the available technical capacity for gas imports to Poland on a continuous basis is 2.3 bn m3 per annum (6.3 m m3 per day). According to Gaz System, in emergency cases (if supplies from the eastern direction to Germany are suspended) it will be possible to import up to 14.9 m m3 of gas per day (or nearly 5.5 bn m3 per annum). On 1 January 2015 the technical capacity for gas imports to Poland on a continuous basis was further increased at the Mallnow point, and consequently at the Interconnection Point (PWP; Lwówek and Włocławek), by 3,951 MWh/h. Concurrently, following the extension of the Włocławek point, its technical capacity for interruptible transmission rose by 7,201 MWh/h (at the exit point from the Transit Gas Pipelines System and entry point to the Transmission Gas Pipelines System). The increased transmission capacity at the Interconnection Point is also related to higher capacity at Mallnow-reverse.

System interconnections to be set up by OGP Gaz-System SA concurrently with extension and upgrade of relevant sections of Poland’s transmission network:

- Connection between the Polish and Czech transmission systems (expected completion – by 2018). The project consists in the construction of a new connection between the Polish and Czech systems with a capacity of approximately 6.5 bn m3 per annum as part of the North-South Corridor. The new connection is to enable bidirectional gas flows. The project is at the stage of preliminary preparations performed jointly with the operator of the Czech transmission system.

- Connection between the Polish and Slovak transmission systems (expected completion – by 2023). The project consists in the construction of a connection between the Polish and Slovak systems with a capacity of approximately 5.7 bn m3 per annum as part of the North-South Corridor. The new connection is to enable bidirectional gas flows. The project is at the stage of preliminary preparations performed jointly with the operator of the Slovak transmission system.

- Enhancement of the capacity for gas imports from Germany (expected completion – by 2018). Depending on market conditions, there may be a need to ensure a higher than currently proposed transmission capacity between the German Gaspool/NCG market areas and the Polish market. This will be possible thanks to increasing the transmission capacity of the existing interconnection points or construction of new ones. Preliminary analyses of such projects are under way. Based on current estimates, a higher transmission capacity may be necessary even before 2018, but this will be consulted with market participants in advance.

- Connection between the Polish and Lithuanian transmission systems (project timeline – by 2023). The project consists in the construction of a new connection between the Polish and Lithuanian systems with a capacity of approximately 2.4-4.1 bn m3 per annum. The new connection is to enable bidirectional gas flows. The project is at the stage of preliminary preparations performed jointly with the operator of the Lithuanian transmission system.

- Connection between the Polish and Ukrainian transmission systems. On 17 December 2014, OGP GAZ-SYSTEM SA and PJSC UKRTRANSGAZ, the Polish and Ukrainian transmission system operators, signed an agreement with the key purpose of defining the rules of cooperation between the parties in preparing analyses of projects necessary for improving the cross-border transmission capacity between Poland and Ukraine. Under the agreement, a feasibility study will be prepared to provide a basis for further decisions on development of the transmission systems in Poland and Ukraine.

Gas wholesale

Tariff policy

Gas fuel trading is regulated by the President of the Energy Regulatory Office (URE). The Office’s regulatory powers include the right to approve gas fuel tariffs, including gas fuel prices and fee rates covered by the tariffs, and ensure their compliance with the Polish Energy Law. To that end, they analyse and review costs that energy companies consider relevant for the calculation of tariff prices and fee rates, and exercise overall supervision over such companies. The level of tariff prices and fees, despite the requirement to sell gas on the exchange market, has a material effect on the Company’s financial performance. The tariff calculation methodology defines prices and fee rates based on forecast costs and gas sales targets, taking into account the costs of gas supply from all possible sources − both imported and domestically produced gas.

Gas fuel is supplied to customers connected to the transmission network and the distribution network under comprehensive service contracts, which are settled based on a tariff specifying:

- prices and subscription fees applicable to settlements with customers receiving gas fuel from the networks,

- manner of determining price reductions in the event of a failure to maintain gas fuel quality parameters or quality standards in customer service.

In 2014, the following Gas Fuel Tariffs were in place:

- Gas Fuel Supply Tariff No 6/2014, approved by a decision of the President of the Energy Regulatory Office, dated 17 December 2013 (effective from 1 January 2014 to 30 June 2014).

- Amendment to Gas Fuel Supply Tariff No 6/2014, approved by a decision of the President of the Energy Regulatory Office, dated 13 June 2014 (effective from 1 July 2014). The amendment was designed to harmonise the tariff with the Minister of the Economy’s Regulation dated 28 June 2013, under which, starting from 1 August 2014, settlements with customers are to be based on energy units, while earlier they were based on units of volume. The new settlement rules did not significantly affect the amounts of payments for gas fuel supplies. The prices of gas fuels, as well as distribution and transmission charge rates were recalculated from amounts expressed per cubic metre into amounts expressed per 1 kWh, with the use of the calorific value adopted to determine prices per unit of volume.

In addition, the President of the Energy Regulatory Office, in a decision of 17 December 2014, approved Gas Fuel Supply Tariff No 7/2015. The new tariff, effective from 1 January 2015 to 30 April 2015, is applicable to businesses purchasing fuels for resale and end users with an annual gas consumption exceeding 25 m m3.

Operations on the Polish Power Exchange (PPE)

After the requirement to sell gas at the power exchange was introduced in 2013 by the Polish Energy Law, PGNiG has naturally become one of the key gas market players at the Polish Power Exchange. PGNiG also acts as a Gas Market Maker at the Polish Power Exchange, committing to regularly place buy and sell orders on the gas futures market. The key role of a market maker is to enhance the market’s liquidity and transparency.

In 2014, the Company was an active trading participant on the Commodity Forward Instruments Market (CFIM), the Day-Ahead Market (DAM) and the Intraday Market (IDM). Following the spin-off of PGNiG Retail in August, the volume of gas sold through the Polish Power Exchange has increased substantially for the entire futures curve and for the spot markets. Due to the strong growth in the volumes of gas sold through the Polish Power Exchange, a substantial portion of the volumes migrated from the tariff-regulated segment to exchange sales, which became one of the key distribution channels for the Company.

In exchange trading, both the selling and the buying party remain anonymous. This results in prices being set at the market level, or at a level where supply matches demand, which gives competitors an opportunity to enter the gas market.

Natural gas trading volume at the Polish Power Exchange in 2014 (mln m3)

Structure of the major industrial customers of the PGNiG Group

The structure of natural gas sales by the PGNiG Group on the wholesale market remains roughly unchanged year on year. The largest customers are nitrogen plants, accounting for approximately 40% of the PGNiG Group’s sales to corporate customers, followed by refineries and petrochemical companies, which accounted for approximately 30% of the Group’s wholesale gas sales, as well as glass works with an 8% share, iron and steel works with a 7% share, and power and CHP plants with a 6% share.

Major industrial customers of the PGNiG Group in 2014

Currently, gas trading licences in Poland are held by 141 non-Group companies. In 2011−2012, 22 new licences were awarded. In 2013−2014, another 63 licences were granted (excluding PGNiG Retail). The growth in the number of new licences shows the extent of interest in the potential of the Polish gas market.

Additionally, 49 companies (excluding PGNiG) hold licences to trade in natural gas with foreign partners, allowing them to import gas for resale to customers in Poland. In 2014, 17 such licences were awarded.

Retail sales of gas

In order to ensure that PGNiG meets the requirement to sell gas on the exchange market, a new company, PGNiG Retail, commenced its operations in August 2014, consisting in buying high-methane natural gas at the Polish Power Exchange (PPE), and then selling it to retail customers. End-user agreements were automatically transferred to PGNiG Retail by way of universal succession.

The formation of PGNiG Retail is another step in the process of separating wholesale and retail trading, after the establishment of the Wholesale Trading Division at PGNiG. The Wholesale Trading Division took over the customers who purchased more than 25 m m3 of natural gas in the previous calendar year, who purchase gas directly from the fields, and who purchase crude oil. The launch of PGNiG Retail’s operations will ensure adequate demand for natural gas sold on the power exchange and will enable fair competition between the PGNiG Group’s subsidiary and other participants of the Polish gas market.

Tariff policy

Pursuant to the Energy Law, PGNiG Retail was authorised to use PGNiG Gas Fuel Tariff (Part B Gas Fuel Supply Tariff No 6/2014) until introduction of a new tariff prepared by PGNiG Retail. In October 2014 PGNiG and PGNiG Retail applied to the President of the Energy Regulatory Office for approval of the new tariff.

On 17 December 2014 the President of the Energy Regulatory Office approved PGNiG Obrót Detaliczny Gas Fuel Trading Tariff No 1, effective from 1 January 2015 to 31 December 2015. The average trading price of gas fuel (gas fuel price and subscription fee) was reduced relative to PGNiG Retail’s previous tariff by 1.8% for high-methane gas (E), 0.8% for nitrogen-rich gas (Lw), 1.1% for nitrogen-rich gas (Ls), and 1.6% for decompressed propane-butane.

On 8 September 2014, PGNiG Retail applied to the President of the Energy Regulatory Office to be exempted from the obligation to submit LNG trading tariffs for approval. On 27 October 2014, the President of the Energy Regulatory Office exempted the company from this obligation.

Competition in gas sale

In 2014 the natural gas market saw a rapid growth of PGNiG Retail’s competitors, i.e. energy companies trading in gas fuel. The company’s main competitors, whose offerings may be of interest to the PGNiG Group’s customers, include DUON Marketing & Trading, RWE Polska, PKP Energetyka, ENEA, Hermes Energy Group and Tauron.

These companies are active on the domestic natural gas market, targeting especially W-5 and W-6 customers, which represent DUON’s core market, and W-7 customers, with PKP Energetyka and RWE Polska being particularly active in this tariff group.

Polish power groups such as ENEA, Tauron and Energa are also becoming increasingly active, using their customer databases to resell gas bundled with their main product − electricity.

To a large extent, these companies rely on gas sourced from the PPE, but also on gas procured from foreign suppliers or bought on gas exchanges, mainly in Germany. However, given the limited capacities at the entry points to the Polish transmission system, the general reluctance to store gas fuel in Poland and the obligations imposed by the diversification regulation, imports are not the main source of gas fuel for these companies.

Gas sales - customer overview

PGNiG Retail’s business customers include chemical and petrochemical companies, glass and steel works and other entities that require process gas for the manufacture of products, as well as businesses buying gas for heating purposes, operating on the heat generation, industrial, services and trade markets. The breakdown of the company’s customer base by tariff groups reveals a very large presence of small and medium-sized customers. A similar relation has been found between sales volumes and the number of customers.

The largest group of customers by number are businesses focusing on trade and services, whereas industrial customers lead in terms of gas volumes received.

According to the Energy Regulatory Office data, in 2014 nearly 6 thousand customers in Poland changed their gas fuel suppliers, with the figure expected to increase in 2015.

Sales of electricity

In 2014 PGNiG engaged in wholesale trading in electricity and related products in Poland and Germany. In Poland, the Company traded on the OTC market under EFET standard agreements and through brokers, and also at the PPE. In Germany, the Company was engaged in spot contract trading on the EPEX Spot market, and in the inter-system Poland-Germany exchange.

In 2014 PGNiG supplied 259.3 GWh of electricity to end users. Since August 2014 PGNiG Retail, a company spun off from PGNiG, has been responsible for active tendering and the acquisition of new customers. Ultimately, PGNiG wants PGNiG Retail to handle all electricity sales to end users. Consequently, electricity sale agreements will be transferred from PGNiG to PGNiG Retail.

PGNiG Retail sells electricity through a network of Business Consultants and Customer Service Offices.

Planned activities in 2015 and beyond

In 2015 PGNiG will face a number of challenges related to the ongoing deregulation of the gas market in Poland.

As regards sales to end users, the Company is focusing on preparing a product offering that would allow it to secure a strong competitive position on the increasingly deregulated gas market. The products will be offered to end users once PGNiG is exempted from the obligation to submit its end-user tariffs for approval.

As regards sales on the gas exchange, PGNiG will focus on offering competitive prices compared with those quoted on deregulated Western markets. This policy should guarantee the Company an ability to meet its statutory exchange sale requirement.

To increase customer satisfaction and mitigate the risk of losing retail customers to competitors, PGNiG Retail is actively expanding its mix of gas-related products and services, as well as improving customer service, for instance by introducing proper customer segmentation, assigning dedicated stationary account managers to W-5 customers, and enabling quicker and more convenient communications through the corporate website and electronic Customer Service Office (e-bok). Work is also under way to facilitate and accelerate PGNiG Retail’s invoice flows by introducing e-invoices and streamlining its IT systems to ensure that customers can receive a single invoice for all gas fuel collection points.

With respect to new gas products, the company is working on its dual fuel offering, a gas product offering tailored to specific customer requirements and, in cooperation with other Group companies, on gas-fired cogeneration.

In addition, the company has intensified work on developing a product offering for customers in areas where the gas distribution network is being or will be rolled out, as well as for customers who intend to switch from coal-fired energy sources to gas, for instance by more effectively reaching customers with information on its products.

Plans for 2015 and subsequent years provide for the further enhancement of the product offering and customer satisfaction, driven by continuous improvement and streamlining of customer service, new communication channels and constant growth of the company, as well as PGNiG’s continued leadership on the Polish gas market.

PGNiG also intends to take steps to further develop the CNG segment by talking with external partners interested in the construction of new compressed-gas filling stations and launching initiatives to promote this environmentally-friendly fuel, especially among municipal transport providers. In addition, work will be carried out to develop the LNG sector, in particular by expanding ship bunkering operations in Polish ports using LNG from the Świnoujście gas terminal.

Higher volumes of electricity sold, separately or bundled in a dual-fuel offering, as well as other products, may bring added value from mutual cooperation to both PGNiG Retail and its customers.

Trade - foreign operations in 2014

Business overview

PGNiG Sales & Trading (PST) is the PGNiG Group’s main entity responsible for energy trading, whose duties also include portfolio optimisation in Western Europe.

PST is active on wholesale energy markets in Germany, the Netherlands, Austria and the Czech Republic, as well as at entry points on their borders. The company sells energy on the German and Austrian markets and provides supplies to end users at entry points.

Apart from the Czech Republic, PST’s markets ensure liquidity levels sufficient for PST to fulfil its role within the PGNiG Group. These markets are supervised by national and EU bodies, and PST holds all relevant permits to trade and sell on these markets, and complies with all locally applicable regulations. PST has sourced substantial amounts of energy for the Group (12.4 TWh), and is a reputable member of the German short-term wholesale gas trading market (GASPOOL).

Given that the Czech energy market is still relatively underdeveloped, in 2014 PST used it only to transfer gas from Germany to Poland.

Risks

In the wholesale trade segment, the following risks are managed:

- Market price risk: global or local changes affect commodity markets; uncertainty leads to higher market volatility (for instance the conflict in Ukraine or lower production from the Groningen field in the Netherlands). A small part of PST’s revenue is earned on transactions executed for its own account. The amount of profit on such transactions is difficult to predict, and it is also possible that this business will generate a loss. The acceptable level of risk is specified in the Risk Management Policy, which is designed to limit the adverse effects of this business.

- Liquidity risk: a lack of liquidity significantly limits transparency and thus may result in higher transaction costs.

- Counterparty credit risk: default by a counterparty may result in PST’s inability to collect payment for delivered goods and/or a negative position posted by PST as a consequence of marking to market and, as a further consequence, may adversely affect PST’s performance.

- Supply risk: supply disruptions/increases affect prices. PST purchases specific volumes of gas produced from Norwegian fields on an ongoing basis. Any unforeseen disruptions in field operations or gas transmission system could disturb the balance of PST’s system for a certain period of time, which could result in additional costs. However, since most costs are incurred by the field operator, PST’s exposure to that risk is limited.

Operations of PST in 2014

Wholesale trade

PST operates principally in Germany. It is active on the EPEX Spot SE, EEX PEGAS and Power, ICE ENDEX Europe and PPE (through Broker Noble) markets.

PST acts as a market maker on the PEGAS platform for the GASPOOL market area in Germany.

It competes with all trading companies active on the markets on which it operates (currently Germany and Austria). These are mainly established market players (RWE/E.ON/Vattenfall/EnBW), companies owned by local governments and independent sellers.

Retail sales

PST’s principal business includes sales of gas and electricity to small and medium-sized businesses and households. As at the end of 2014 PST had approximately 60 thousand customers, most of them in Germany, with a small percentage in Austria.

Planned activities in 2015 and beyond

Regarding PST’s operations, plans for the coming years include the separation of PST’s wholesale and retail business, the further expansion of the customer base for PST’s sales operations, the launch of sales operations in Poland, the launch of an LNG trading business, and the entry into new trading markets (e.g. the UK).

The objective is to significantly expand PST’s base of end users in Germany and Austria, to promote sales to strategic customers on the German-Polish border and in Poland, and to launch the international LNG business.

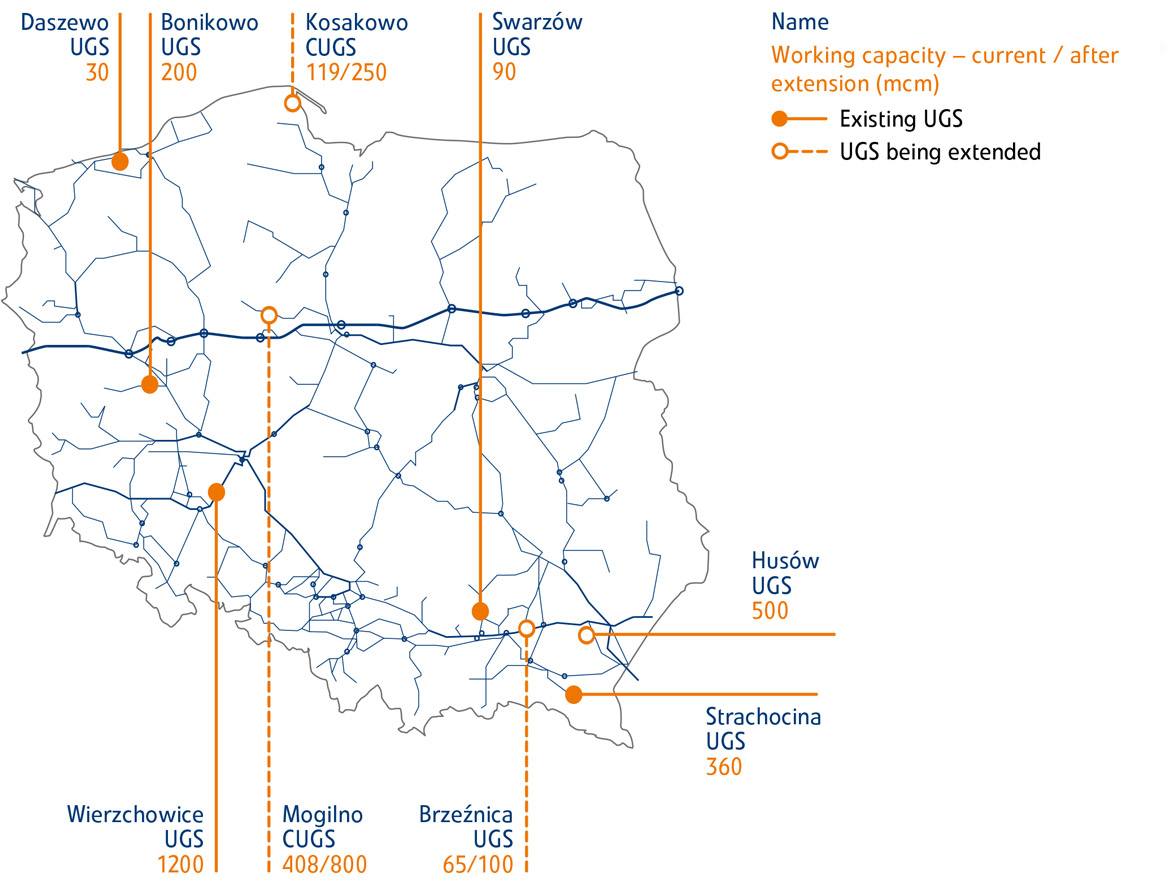

Storage

The Trade and Storage segment uses for its own needs the working capacities of the Wierzchowice, Husów, Strachocina, Swarzów and Brzeźnica underground gas storage facilities (UGS), as well as the Mogilno and Kosakowo underground gas storage cavern facilities (CUGS). A part of the working capacity of the Mogilno facility, which was made available to OGP Gaz-System SA, is not a storage facility within the meaning of the Polish Energy Law.

Short-term peak fluctuations in demand for natural gas may be balanced by supplies from the Mogilno and Kosakowo facilities, where gas is stored in worked-out caverns. The capacities of the Wierzchowice, Husów, Strachocina, Swarzów and Brzeźnica facilities are used to minimise the effect of changes in the demand for natural gas in the summer and winter seasons, to meet the obligations under the take-or-pay import contracts, to ensure the continuity and security of natural gas supplies, and to meet the obligations under contracts for gas deliveries to customers’ premises.

The capacities of the Wierzchowice, Husów, Mogilno and Strachocina facilities are also used by PGNiG to meet its obligation to maintain mandatory stocks, imposed by the Act on Stocks of Crude Oil, Petroleum Products and Natural Gas, as well as on the Rules to be Followed in the Event of a Threat to National Fuel Security or Disruptions on the Petroleum Market, dated 16 February 2007.

The storage capacities of PGNiG’s facilities are managed by Operator Systemu Magazynowania Sp. z o.o. (OSM).

In 2014 the parameters of the individual underground gas storage facilities were as follows:

| Working capacity 2009 (mcm) |

Working capacity 2014 (mcm) |

Maximum injection capacity (mcm/d) |

Maximum withdrawal capacity (mcm/d) |

|

|---|---|---|---|---|

| Brzeźnica UGS | 65 | 65 | 1.10 | 0.93 |

| Husów UGS1) | 350 | 500 | 4.15 | 5.76 |

| Mogilno CUGS | 378 | 408 | 9.60 | 18.00 |

| Kosakowo CUGS2) | 0 | 119 | 2.40 | 9.60 |

| Strachocina UGS | 150 | 360 | 2.64 | 3.36 |

| Swarzów UGS | 90 | 90 | 1.00 | 1.00 |

| Wierzchowice UGS | 575 | 1,200 | 6.00 | 9.60 |

| Daszewo UGS (Ls) – E&P segment | 30 | 30 | 0.24 | 0.38 |

| Bonikowo UGS (Lw) – E&P segment | 0 | 200 | 1.68 | 2.40 |

| Total | 1,638 | 2,972 |

1) On 30 December 2014 the project involving the extension of the Husów underground gas storage facility to bring its working capacity from 350 million to 500 million cubic metres was completed; the new storage capacities of the Husów facility are to be made available to OSM after the end of the 2014/2015 winter season.

2) On 22 December 2014 two new caverns with a total working capacity of 51.2 m m3 were completed at the Kosakowo underground gas storage cavern facility; the new storage capacities of the Kosakowo facility are to be made available to OSM after the end of the 2014/2015 winter season.

Location of underground gas storage facilities

Tariff

Until 16 July 2014 OSM carried out settlements relating to storage services based on the rates provided for in the amendment to Gas Fuel Storage Tariff No 1/2012 of 17 December 2012. On 2 July 2014, the President of the Energy Regulatory Office approved Gas Fuel Storage Tariff No 1/2014. The new tariff, effective from 17 July 2014 until 31 March 2015, takes account of the new storage capacities made available at the Kosakowo cavern facility, as well as expanded capacities of the Wierzchowice and Strachocina facilities. Furthermore, the tariff provides for making settlements with customers in energy units starting from 1 August 2014.

Storage services

In accordance with its licence for gas fuel storage, OSM provides its services at the Brzeźnica UGS, Husów UGS, Mogilno UGSC, Wierzchowice UGS, Strachocina UGS and Swarzów UGS facilities.

As at 31 December 2014, the PGNiG Group made available a total of 2,523.5 m m3 of working storage capacity for third party access (TPA) and to OGP Gaz-System SA; of this volume, 2,502.0 m m3 was made available under long-term agreements and 21.5 million cubic metres – under short-term agreements. 0.6 m m3 is the technical reserve capacity.

EU programmes

EU co-financing was secured for the following underground storage facility construction/extension projects carried out in 2014:

- Husów underground gas storage facility – maximum EU contribution: PLN 35.1m,

- Kosakowo underground gas storage cavern facility – maximum EU contribution: PLN 115.4m,

- Wierzchowice underground gas storage facility – maximum EU contribution: PLN 491.2m.

These projects are co-financed by the European Union from the European Regional Development Fund under the Infrastructure and Environment Operational Programme 2007−2013, Measure 10.1: Development of transmission systems for electricity, natural gas and crude oil, as well as the construction and reconstruction of natural gas storage facilities, Priority X: Energy security, including the diversification of energy sources.

Capital expenditure in 2014

In 2014, the following investment projects were completed:

- the extension of the Husów underground gas storage facility from 350 m m3 to 500 m m3 of working capacity,;

- the construction of two new caverns with a total working capacity of 57.8 m m3 at the Kosakowo underground gas storage cavern facility.

Planned activities

The following capex activities on underground gas storage facilities are planned for 2015:

- completion of three caverns with a total working capacity of approximately 190 m m3 at the Mogilno underground gas storage cavern facility (Z-15, Z-16 and Z-17),

- continuation of the construction of the K-5 cavern with a working capacity of not less than 25 m m3 at the Kosakowo underground gas storage cavern facility (project completion scheduled for 2016),

- continuation of the extension of the Brzeźnica underground gas storage facility from 65 million to 100 m m3 of working capacity (project completion scheduled for 2016).

In addition to the above projects, projects related to the extension of the Mogilno underground gas storage cavern facility up to a working capacity of approximately 800 m m3 (project completion

scheduled for 2024) and the construction of the Kosakowo underground gas storage cavern facility with a working capacity of not less than 250 m m3 (project completion scheduled for 2021) are planned for 2015 and subsequent years.

Extension plans

| Working capacity present (m m3) |

Working capacity planned (m m3) |

Planned year of completion of construction/extension |

|

|---|---|---|---|

| Brzeźnica UGS | 65 | 100 | 2016 |

| Mogilno CUGS | 408 | ok. 800 | 2024 |

| Kosakowo CUGS | 119 | at least 250 | 2021 |

KRS 0000059492, NIP 525-000-80-28, kapitał zakładowy 5 900 000 000 zł – opłacony w całości

Centrala Spółki ul. M. Kasprzaka 25, 01-224 Warszawa

tel.: +48 22 589 45 55, faks: +48 22 691 82 73