Exploration and Production

This segment’s business focuses on extracting hydrocarbons from deposits and preparing products for sale. The segment comprises the entire process of oil and gas exploration and production, from geological analyses, to geophysical surveys and drilling work, to field development and hydrocarbon production. The work is conducted by the segment on its own, or jointly with partners under joint operations agreements. It relies on storage capacities available at the Daszewo and Bonikowo Underground Gas Storage Facilities.

The PGNiG Group is the leader of the Polish hydrocarbon exploration and production market. As of 1990, hydrocarbon exploration in Poland is based on a licensing policy that ensures equal access to exploration licences for all market participants. Over the past 25 years, a number of foreign companies have carried out explorations in Poland, including globally-known players such as Amoco, Texaco, Conoco and Exxon. At the same time, new exploration companies were established by Polish petrochemical giants PKN Orlen and Grupa LOTOS. At the end of 2014, 21 companies were engaged in hydrocarbon exploration in Poland. Despite this highly competitive environment, the PGNiG Group has maintained its leading position − no foreign company has independently made a material discovery or become the operator under a production licence. As regards oilfield services, a number of international companies such as Schlumberger, Halliburton, Weatherford and United Oilfield Services, also operate in Poland. Despite the intense competitive pressure, PGNiG Group companies GEOFIZYKA Kraków, GEOFIZYKA Toruń and Exalo Drilling enjoy a strong position in this market area.

Analysis of financial performance in 2014

Operating profit of the Exploration and Production segment was PLN 2,006m, down PLN 325m (14%) on 2013. At PLN 3,143m, EBITDA was lower than the year before – by PLN 238m (7%). The segment’s revenue was down by PLN 114m (2%) year on year, despite a nearly 6% growth in oil sales volumes. The revenue decline reflected a slump in crude oil prices (the average annual price of Brent in PLN was 10% lower in 2014 than in the previous year). A PLN 211m (5%) increase in operating expenses was a result of impairment losses recognised on exploration and production assets. The impairment losses were recognised as a result of a change in the calculation of future cash flows (for impairment test purposes):

- previously the tariff price of gas was used in the calculations, while now they are based on the market price; the calculation method was revised as a result of changes in the natural gas market, including in particular the ongoing deregulation of gas prices and the introduction of the statutory requirement to sell gas on the exchange market,

- the expected new tax expenses in connection with hydrocarbon production were taken into account.

The impairment losses on assets, which constrained the segment’s operating profit, amounted to PLN 707m as at the end of 2014. In addition, based on an analysis of the Group’s licences and the effectiveness of its exploration programme, the Group charged PLN 330m of expenditure incurred on dry wells and seismic data acquisition to the segment’s expenses at the end of 2014. An increase of PLN 87m (8%) in amortisation and depreciation is related chiefly to the Norwegian assets and follows directly from increased crude oil production.

| Exploration and Production PLNm |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| Segment’s total revenue | 6,071 | 6,185 | 4,325 | 4,081 | 3,452 | 3,201 |

| Segment’s total expenses | -4,065 | -3,854 | -2,972 | -2,954 | -2,864 | -2,865 |

| EBIT | 2,006 | 2,331 | 1,353 | 1,126 | 588 | 337 |

| Segment’s assets | 15,442 | 15,364 | 16,580 | 14,923 | 12,797 | 11,063 |

| Segment’s liabilities | 5,531 | 4,954 | 5,823 | 2,177 | 1,863 | 1,608 |

Segment’s figures

| NATURAL GAS PRODUCTION, PGNiG Group m m3 |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| HIGH-METHANE GAS (E) | 1,876 | 1,890 | 1,607 | 1,616 | 1,605 | 1,634 |

| including in Poland | 1,457 | 1,550 | 1,607 | 1,616 | 1,605 | 1,634 |

| including in Norway | 418 | 340 | - | - | - | - |

| NITROGEN-RICH GAS (Ls/Lw as E equiv.) | 2,627 | 2,692 | 2,710 | 2,713 | 2,615 | 2,471 |

| including in Poland | 2,569 | 2,667 | 2,710 | 2,713 | 2,615 | 2,471 |

| including in Pakistan | 58 | 25 | - | - | - | - |

| TOTAL (measured as E equivalent) | 4,503 | 4,582 | 4,317 | 4,329 | 4,220 | 4,105 |

| CRUDE OIL, CONDENSATE AND NGL, PGNiG Group ths tonnes |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| Production of crude oil and condensate | 1,207 | 1,098 | 492 | 468 | 501 | 503 |

| including in Poland | 789 | 815 | 492 | 468 | 501 | 503 |

| including in Norway | 418 | 283 | - | - | - | - |

| Sprzedaż ropy naftowej i kondensatu | 1,169 | 1,106 | 485 | 469 | 501 | 506 |

| including in Poland | 780 | 809 | 485 | 469 | 501 | 506 |

| including in Norway | 389 | 297 | - | - | - | - |

Regulatory environment

The main legislative act governing business activities in the area of hydrocarbon exploration and production in Poland is the Geological and Mining Law. It regulates the ownership of minerals, the conditions for the organisation and supervision of mining and geological work, and the responsibility for damage caused by mining operations. Geological and mining activities are subject to supervision by competent geological and mining supervision authorities. The Geological and Mining Law provides for criminal sanctions for a failure to comply with its regulations, and specifies the upper and lower limits of royalty fees.

On 11 July 2014 a new Act Amending the Geological and Mining Law was passed, introducing a number of material changes to the regulatory environment of the exploration and production segment, including an integrated licence (covering hydrocarbon exploration, appraisal and production) and obligatory qualification procedures. It also allowed consortia to apply for licences and significantly increased royalty fees (while maintaining the previous royalty regime for marginal deposits).

The new licensing system introduced by the new Act Amending the Geological and Mining Law of 11 July 2014 may significantly slow down the administrative processes, ultimately leading to a decline in the number of hydrocarbon exploration and appraisal licences issued in Poland.

A new legislative act forming part of the legal framework for the exploration and production segment is the Act on Special Hydrocarbon Tax, passed by the Polish Parliament on 25 July 2014. It introduces to the Polish tax regime a special hydrocarbon tax (tax on profits from hydrocarbon production) and adds crude oil and natural gas production to the list of activities specified in the Act on Tax on Production of Certain Minerals of 2 March 2012 subject to the tax on the production of certain minerals.

The act will come into force on 1 January 2016. The obligation to pay the special hydrocarbon tax and the tax on production of certain minerals in respect of production of oil and gas will arise as of 1 January 2020.

The introduction of the taxes specified above will significantly increase PGNiG’s tax burden, which may have an adverse effect on the Company’s financial performance and, consequently, on its ability to invest.

PGNiG’s exploration and production operations abroad are regulated by local legislation and executed agreements (such as the Exploration and Production Sharing Agreement (EPSA) in Libya).

In Norway, the legal basis for the licensing system is the Petroleum Act of 1996. As the Norwegian state remains the owner of mineral deposits on the Norwegian Continental Shelf, official approvals and permits are required at all stages of the process – from the grant of an exploration or production licence, through the acquisition of seismic data, drilling and development of fields, to the decommissioning of wells.

Production licences are usually awarded in licensing rounds. A licence is awarded for an initial period (exploration stage) of up to ten years. During that stage, the licence holder is required to perform a declared work programme (geophysical and geological surveys, drilling work). Following the first stage, the licence may be relinquished or extended if a decision is made to develop the field.

Norway has in place a special system for the taxation of income from hydrocarbon production, which is based on the standard corporate income tax (CIT) regime and on a special petroleum tax. The corporate income tax rate is 27%, while the special petroleum tax is charged at a rate of 51%. When calculating taxable income for the purpose of corporate income tax and special petroleum tax, investments are depreciated using the straight-line method over a period of six years beginning from the year in which they were made. All costs, including exploration costs, research and development costs, financing costs, operating expenses and decommissioning costs, can be deducted. The consolidation of tax accounts for different licences/fields is permitted. Additionally, companies may also be granted an investment incentive under which they may increase the amount of depreciable expenditure by 22% of the investment project value (5.5% annually over four years starting from the year in which the investment project was commenced). In addition, a company not generating income from production is entitled to a reimbursement of 78% of its exploration expenditure in the year subsequent to the year in which the expenditure was incurred, while tax losses may be carried forward indefinitely.

Risks

Resource discoveries and estimates

The main risk inherent in exploration activities is the risk of failure to discover resources, i.e. exploration risk. This means that not all the identified potential deposit sites actually have deposits of hydrocarbons that can qualify as an accumulation.

The reserves estimates and production projections may be erroneous due to imperfections inherent in the equipment and technology, which affect the quality of acquired information concerning the geological factors and reservoir characteristics. Irrespective of the methods applied, data on the volume and quality of commercial reserves of crude oil and natural gas is always an estimate, while actual production, income and expenses may significantly differ from such estimates. The weight of this risk is further increased by the fact that, in the full business cycle, the period from commencing exploration to launching production from a developed field takes six to eight years, while the production phase lasts from 10 to 40 years. Formation characteristics defined at the stage of determining reserves are reviewed after production starts. Each downward revision of the size of reserves or estimated production quantities may lead to lower-than-expected revenue, and adversely affect the PGNiG Group’s financial performance.

A risk associated with the exploration for unconventional gas in Poland relates to the lack of proven reserves of shale gas and tight gas. Even if the existence of in-place petroleum is confirmed, its production may prove uneconomic due to poor gas recovery and high investment expenditure necessary for well drilling and the construction of production infrastructure. Another material factor is that access to unconventional gas plays may sometimes be difficult given the environmental regulations and the need to obtain the landowners’ consent for access.

Delayed work

Under the applicable Polish legal regulations, obtaining a licence for the exploration for and appraisal of crude oil and natural gas deposits lasts from one to one and a half years. On foreign markets, such procedures may take even two years from the time the winning bid is awarded in a licensing tender until the relevant contract is ratified. Prior to the commencement of field work, the Company is also required to make a number of arrangements, including obtaining formal and legal permits and approvals for entering the area, meeting environmental protection-related requirements and, in some cases, requirements related to the protection of archaeological sites, and abiding by the regulations governing tenders held to select a contractor, which delays the execution of an agreement with a contractor by another few months. Frequently the waiting time for customs clearance of imported equipment is very long. These factors create a risk of delays in the start of exploration work.

Formal and legal hurdles beyond PGNiG’s control that significantly delay implementation of investment projects are related, among other things, to local zoning plans, the need to obtain administrative decisions (including environmental decisions), amendments to the current concept of the investment project, as well as obstacles in obtaining permission from land owners to enter the site.

Delays in implementing an entire project and a protracted investment process exacerbate the risk related to the amount of required capital expenditure and its estimation.

Cost of exploration

Exploratory work is capital intensive, given the prices of energy and materials. The cost of exploratory work is especially sensitive to steel prices, which are passed onto the prices of casing and production tubing used in well completion. An increase in the prices of energy and materials drives up the cost of exploratory work. Moreover, the profitability of foreign exploration projects depends to a significant extent on the prices of oil derivative products and on currency exchange rates. To reduce drilling costs, PGNiG introduced the daily rate system into its drilling contractors selection procedure in 2011.

Unforeseen events

Hydrocarbon deposits developed by PGNiG are often at great depths, which involves extremely high pressures and, in many cases, the presence of hydrogen sulphide. Consequently, the risk of a hydrocarbon blowout or leakage is very high, which in turn may pose a threat to people (workers and local populations), the natural environment and production equipment.

To mitigate individual risks, the PGNiG Group takes the following measures:

- to mitigate contractor or supplier risk − the Group incorporates appropriate clauses into its contracts (e.g. contractual penalties), and takes care to select proven sub-contractors,

- to mitigate force majeure risk − the Group enters into insurance contracts,

- to mitigate technical risk – the Group follows a policy of rational management of deposits,

- to mitigate risk related to the project’s environment – the Group takes such remedial measures as selecting an alternative location or alternative project implementation method, conducting negotiations, complying with official deadlines, changing the schedule and organisation of work.

Competition

Both on the Polish market and abroad, there is a risk of competition from other companies in the acquisition of licences for the exploration and appraisal of hydrocarbon deposits. Certain competitors of PGNiG, especially those active globally, enjoy strong market positions and have greater financial resources than those available to the Group. Thus, it is probable that such companies would submit their bids in tender procedures and be able to acquire promising licences, offering better terms than PGNiG could offer, given its financial and human resources. This competitive advantage is particularly important on the international market.

The presence of foreign companies on the Polish market has intensified competition for highly qualified employees with extensive professional experience. This risk of losing experienced personnel is especially high with respect to oil and gas exploration professionals. In countries where PGNiG operates, highly qualified staff are difficult to recruit.

Safety, environmental protection and health regulations

Ensuring compliance with environmental laws in Poland and abroad may significantly increase PGNiG’s operating expenses. Currently, PGNiG incurs significant capital expenditure and costs on ensuring compliance of its operations with the ever more complex and stringent regulations concerning safety and health at work, as well as environmental protection. For instance, in 2005 more stringent regulations on the execution of projects potentially affecting Natura 2000 sites were introduced, and environmental protection-related requirements were strengthened with regard to entering areas where protected plant species occur and habitats of protected animals are found.

Operations in Poland in 2014

Exploration and evaluation work

In 2014 PGNiG was involved in crude oil and natural gas exploration and appraisal projects in the Carpathian Mountains, Carpathian Foothills and Polish Lowlands, both on its own and jointly with partners.

As at the end of 2014, PGNiG held 77 licences for hydrocarbon exploration (84 as at 1 January 2014).

Following a series of geological and formation tests assessing the probability of discovering and documenting substantial hydrocarbon reserves, the Company decided to relinquish 14 licences prior to their expiry. In 2014 eight new licences were acquired in the Bieszczady Mountains (Bieszczady blocks), and one new licence application was filed. One licence was not extended.

Drilling work in areas covered by licences awarded to PGNiG was performed on 24 wells, including 15 exploration wells, 6 research wells and 3 appraisal wells. Out of the 24 boreholes, ten were drilled in search for unconventional hydrocarbons.

In 2014 six wells were drilled with positive results, including one exploration borehole in Pomerania (drilled in the past), two exploration boreholes in the Greater Poland region, and three appraisal boreholes in the Carpathian Foothills (including one in search of unconventional deposits). A total of 14 wells (five of which had been drilled in previous years) failed to yield a commercial flow of hydrocarbons and were abandoned.

Exploration for shale gas

Natural gas is the cleanest fossil fuel, generating low greenhouse gas emissions and no harmful by-products. The advances in and lower cost of extraction technologies have enabled access to new, previously disregarded natural gas resources, i.e. tight gas, shale gas and coal bed methane.

Shale gas, one of the three unconventional gas types, is produced from sedimentary shale rock located deep underground. Shale rock has low permeability, which is why more complex and sophisticated production methods are required to extract shale gas.

Put in simple terms, shale gas production consists in drilling a horizontal well in shale rock and filling the opening with a mixture of water, quartz sand and chemical additives that cause the rock to fracture, releasing the gas.

According to the Energy Information Administration, by 2030 shale gas will account for 7% of all natural gas produced globally.

Poland has substantial shale gas resources in Pomerania, the Warsaw region and around Lublin, but gas can only be produced from formations with suitable characteristics.

Based on the North American experience, several renowned American institutions undertook to estimate Polish shale gas resources.

In March 2012, the Polish Geological Institute − National Research Institute (PGI − NGI) published its first report on the estimated recoverable reserves of natural gas and crude oil in Polish shale formations.

The estimated recoverable reserves of natural gas ranged widely from 37.9 bn m3 to 1,919.7 bn m3, with the extreme values at both ends of the range considered very unlikely. Based on the most probable assumptions, the volume totals between 346.1bn m3 and 767.9bn m3. However, the figures in the report should be viewed as an opening balance, calculated based on data from 39 research wells drilled in 1950-1990 by the Geological Institute, which will be updated as more data from appraisal wells are acquired.

Short history of the assessment of unconventional hydrocarbon resources in Poland

BLN m3

A comparison of the geological data from Poland and the US indicates several geological challenges that will confront companies that have acquired unconventional gas exploration licences.

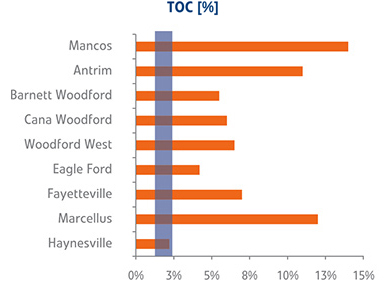

- Total Organic Carbon − an indicator of the amount of organic matter in rock, determining how much gas can be sourced from a given reservoir. In Poland, the metric stands at about 2%-5%, whereas in the US it ranges from 2% to as much as 14%.

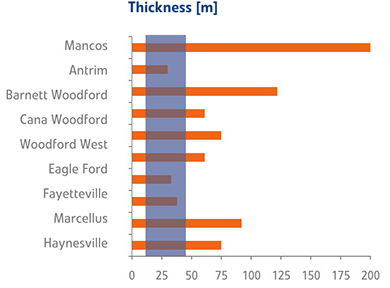

- Thickness of the source rock − the thicker the rock, the better production prospects. In Poland, the average horizontal thickness is ca. 30-70 metres, compared with 20-200 metres in the US.

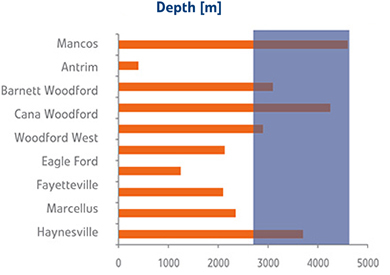

- Depth – depth at which production is possible. In Poland, shale rock is located at greater depths than in the US (3,000-4,000 metres vs. 400-4,600 metres).

- Mineral composition – mineral content in source rock. In Poland, source rock includes chiefly mudstone and claystone, which are difficult to fracture.

As at the end of 2014, the Ministry of Environment had issued 53 licences for the exploration of unconventional deposits of natural gas in Poland, of which 11 are held by PGNiG.

To date, i.e. in 2009-2014, PGNiG drilled 17 wells, including two horizontal wells, and carried out eight 2D and five 3D seismic surveys to determine shale gas potential in Poland.

Work was carried out in three areas:

- Pomerania,

- Central Poland,

- Lublin region.

For more information, go to www.lupkipolskie.pl.

Comparison of the geological data from Poland and the US

The grey band marks the average values estimated for Poland.

The grey band marks the average values estimated for Poland.

Geological and geophysical surveys, drilling and well services

In 2014 the Exploration and Production companies provided services related to drilling exploration, appraisal, core and production boreholes, as well as boreholes required for the construction and extension of underground gas storage facilities. Other important areas of their activity included the provision of specialist well servicing and geophysical services.

Exploration, appraisal and core boreholes were drilled mainly in search for hydrocarbons, but also for copper. Drilling services were rendered in Poland and abroad both for the PGNiG Group and third-party customers.

In Poland, contracts were performed for companies exploring for:

- conventional gas, e.g. for PGNiG, FX Energy Poland Sp. z o.o. and Energia Karpaty Zachodnie Sp. z o.o. Sp. k.,

- unconventional gas, e.g. for PGNiG, Orlen Upstream Sp. z o.o. (exploration for shale gas) and the Polish Geological Institute (coalbed methane),

- unconventional crude oil, for Wisent Oil &Gas Sp. z o.o. (exploration for shale oil),

- copper deposits, for KGHM Polska Miedź SA, Zielona Góra Copper Sp. z o.o. and Mozów Copper Sp. z o.o.

Furthermore, boreholes were drilled as part of the Kosakowo underground storage facility construction project and the Mogilno underground gas storage cavern facility extension project.

The segment companies also provided specialist well services such as drilling fluid services, cementing services, coiled tubing and nitrogen unit operations, mud logging, services consisting in the provision of downhole equipment and well testing, reservoir measurements and production tests, as well as remedial treatments, workovers, and well abandonment services. Well services were primarily performed for PGNiG. Domestically, the main third-party customers for well services included LOTOS Petrobaltic SA, FX Energy Poland Sp. z o.o., Orlen Upstream Sp. z o.o., Wisent Oil&Gas Sp. z o.o., Geops Deep Drilling Sp. z o.o., Przedsiębiorstwo Budowy Kopalń PeBeKa SA, the Polish Geological Institute and Chevron Polska Energy Resources Sp. z o.o.

In 2014, companies of the Exploration and Production segment performed geophysical services in the area of exploration geophysics (including the acquisition, processing and interpretation of seismic data) and well logging. In the Polish market, their most important customers included PGNiG, Chevron Polska Energy Resources Sp. z o.o., FX Energy Poland Sp. z o.o., NAFTA a.s. and Orlen Upstream Sp. z o.o. For PGNiG, the Exploration and Production segment companies performed exploration geophysics services; for third-party customers, they provided both exploration geophysics and well logging services.

Reserves

Recoverable reserves in Poland in 2008-2014

| Recoverable reserves | |||||

|

natural gas (measured as high-methane gas equivalent) bn m3 |

crude oil (including condensate) m tonnes |

natural gas mboe | crude oil mboe | total mboe | |

| 2008 | 91.12 | 20.34 | 573.13 | 149.09 | 722.22 |

| 2009 | 96.65 | 20.00 | 607.93 | 146.60 | 754.53 |

| 2010 | 94.17 | 20.59 | 592.32 | 150.92 | 743.24 |

| 2011 | 93.62 | 20.37 | 588.87 | 149.31 | 738.18 |

| 2012 | 89.80 | 19.93 | 578.94 | 146.09 | 725.03 |

| 2013 | 85.37 | 19.27 | 550.38 | 141.25 | 691.63 |

| 2014 | 81.68 | 18.57 | 526.57 | 136.14 | 662.71 |

Reserves to production (R/P) ratio in 2009-2014

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

|---|---|---|---|---|---|---|

| R/P | 20.88 | 20.68 | 22.65 | 23.13 | 23.71 | 24.49 |

Production

Natural gas and crude oil in Poland is extracted by two PGNiG branches: the Zielona Góra Branch and the Sanok Branch. The Zielona Góra Branch produces crude oil and nitrogen-rich natural gas at 22 sites, including 13 gas production facilities, 6 oil and gas production facilities and 3 oil production facilities. The Sanok Branch produces high-methane and nitrogen-rich natural gas and crude oil at 37 sites, including 20 gas production facilities, 11 oil and gas production facilities and 6 oil production facilities.

In 2014, in the Sanok Branch area two wells on the already producing fields, four wells within exploratory licence areas and four new fields: Łapanów, Pogwizdów, Mołodycz and Wola Rokietnicka, were brought on stream. The total addition to production capacity is approximately 10.3 thousand m3 of gas per hour (high-methane gas equivalent).

In the Zielona Góra Branch area, two wells were brought on stream on the already producing fields: one well on the Radlin field and one well on the Lisewo field (in partnership with FX Energy Poland Sp. z o.o.), with a total production capacity of 3.9 thousand m3 per hour (high-methane gas equivalent). The Komorze field, with a production capacity of 1.0 thousand m3 per hour (high-methane gas equivalent), was also brought on stream in partnership with FX Energy Poland Sp. z o.o. Additionally, in 2014 one oil well was brought on stream on the new Ołobok field, with a production capacity of 15 tonnes per day.

| NATURAL GAS PRODUCTION in Poland m m3 |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| HIGH-METHANE GAS (E) | 1,457 | 1,550 | 1,607 | 1,616 | 1,605 | 1,634 |

| NITROGEN-RICH GAS (Ls/Lw as E equiv.) | 2,569 | 2,667 | 2,710 | 2,713 | 2,615 | 2,471 |

| TOTAL (measured as E equivalent) | 4,026 | 4,217 | 4,317 | 4,329 | 4,220 | 4,105 |

| CRUDE OIL AND CONDENSATE in Poland ths tonnes |

2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| Production of crude oil and condensate | 789 | 815 | 492 | 468 | 501 | 503 |

Underground gas storage facilities

In 2014, the Exploration and Production segment used the working capacities of the Daszewo and Bonikowo nitrogen-rich gas storage facilities. Storage capacities used for the purposes of production are not storage facilities within the meaning of the Polish Energy Law.

| Working capacities of the underground storage facilities used by the Exploration and Production segment as at 31 December 2014. |

Working capacity (m m3) |

Maximum injection capacity (m m3/d) |

Maximum withdrawal capacity (m m3/d) |

|---|---|---|---|

| PMG Daszewo (Ls) | 30 | 0.24 | 0.38 |

| PMG Bonikowo (Lw) | 200 | 1.68 | 2.40 |

Sales

W ramach segmentu Poszukiwanie i Wydobycie, sprzedaż gazu ziemnego i ropy naftowej realizowana jest bezpośrednio ze złóż (z pominięciem systemu przesyłowego) dedykowanymi gazociągami do konkretnych klientów, a w przypadku ropy naftowej – za pośrednictwem tankowców.

Natural gas is sold by PGNiG’s Exploration and Production segment directly from the fields (outside the transmission system), from which it is supplied to specific customers via dedicated pipelines, while crude oil is shipped by sea tankers.

Other products obtained in the process of crude refining include crude condensate, sulphur and propane-butane. Some of the produced nitrogen-rich gas is further treated into high-methane gas at the Odolanów and Grodzisk Wielkopolski nitrogen rejection units. Apart from high-methane gas, the cryogenic processing of nitrogen-rich gas yields such products as liquefied natural gas (LNG), gaseous and liquid helium and liquid nitrogen.

Direct sales of natural gas are transacted on the free market, with delivery terms (including pricing) agreed with customers on a case-by-case basis, depending on the characteristics of a given project. In Poland, the largest amounts of natural gas were sold to industrial customers, accounting for about 78% of the total sales volume. This form of purchase is preferred by customers located in close proximity to gas production sites. Sales of natural gas directly from the fields enable the commercially viable development of gas reserves with quality deviating from network standards and attracting customers for whom gas deliveries from the transmission system are not feasible for technical or economic reasons.

PGNiG sells crude oil on free market terms, pricing it with reference to crude prices quoted on international markets. In 2014 PGNiG sold crude oil through the following channels:

- via pipelines to foreign customers,

- via overland transport (road and rail tankers) – to domestic customers.

PGNiG sold crude oil to Shell International Trading and Shipping Company Ltd., Rafineria Trzebinia SA, Rafineria Nafty Jedlicze SA, TOTSA TOTAL OIL TRADING SA and BP Europe SE. In November 2014 PGNiG and Rafineria Trzebinia SA signed an annex to their agreement. Under the annex, the cost of rail transport was transferred to the buyer. Since January 2015 Rafineria Trzebinia SA has been responsible for crude oil transport from PGNiG’s railway terminals to relevant destinations, covering all related costs.

Capital expenditure in 2014

The 2014 Capex Plan provided for several dozen projects to maintain production capacity (drilling of production wells, field and well development). In addition to key projects such as Radlin, Księżpol, Radoszyn, Lisewo, Różańsko and Wilków, capex tasks implemented in the upstream segment included the development of regional gas reserves, projects executed to sustain or restore hydrocarbon production rates (upgrade and extension of existing gas production facilities), projects designed to improve the operation of production branches (upgrade of existing technical/administrative infrastructure, purchase of capital goods), projects designed to increase or maintain the production capacities of the Odolanów Branch.

Apart from the key projects, other major investment projects implemented in the upstream segment in 2014 included: the installation and upgrade of field compressors at Gas Production Facilities, the development and hook-up of wells, as well as the upgrade of the KRIO production installation in Odolanów.

The key projects completed in 2014 included the development of the Lisewo and Komorze fields, the development of the Lisewo-2k and Radlina 64 wells, the development of the Maćkowice 3K and Mołodycz 1 and 2 wells, and drilling work on more than 10 wells.

Other projects completed in 2014 included the development of the Maćkowice 2, Jata 1, Lubliniec 12 and Dzików Stary 2 wells, the upgrade of the Żuchlów gas compressor station, the construction of a compressor station at the Zielin Oil and Gas Production Facility, as well as a dozen or so other minor projects involving upgrade and extension of gas production facilities and production installations in Odolanów.

Foreign operations in 2014

Licenses in Europe

Norway

PGNiG Upstream International AS (PGNiG UI, formerly PGNiG Norway AS) was established for the purpose of the Norwegian Continental Shelf project, the aim of which is to provide access to new recoverable reserves of oil and gas outside Poland. The principal business objective of PGNiG UI is the exploration for and production of crude oil and natural gas on the Norwegian Continental Shelf. PGNiG UI has been pre-qualified as an operator by Norwegian authorities.

In 2014 PGNiG UI acquired interests in four fields on the Norwegian Continental Shelf from Total E&P Norge AS (PGNiG UI is not the operator for the fields). The transaction involved three producing fields (Morvin, Vilje and Vale), and one field under development (Gina Krog). According to an independent expert’s report, PUI’s 2P recoverable reserves are estimated at 33 million boe. According to operator data, the remaining average lifetime of the fields is estimated at 14 years. Following the acquisition of interests in the new fields, PGNiG UI estimates its production volume in Norway to reach approximately 15,000−20,000 boe per day over the next ten years.

A significant portion of the transaction price was covered with cash flows generated in the period between the effective date of the agreement and the transaction closing date. Given the achieved sales targets of hydrocarbons produced from the acquired fields in 2014, as well as reduced costs and capital expenditure, the ultimate cash payment amounted to approximately NOK 844m, which accounted for 43% of the purchase price.

Besides the acquisition of production assets from Total E&P Norge AS, it is also important to note the strong production figures of the Skarv field, PUI’s key asset. PGNiG UI’s acquisitions in 2014 included an interest in one new licence for which it acts as the operator − awarded to PGNiG UI in the APA2013 licensing round. During the year, PGNiG UI also relinquished two licences, returning them to the licensing authorities. In 2014 PGNiG UI continued to optimise its financing structure, which included the early repayment of financial debt.

PGNiG’s 2015 production volume in Norway is projected to reach 510 thousand tonnes of crude oil (including NGL) and 0.4 bn m3 of natural gas.

| NATURAL GAS PRODUCTION in Norway m m3 |

2014 | 2013 |

|---|---|---|

| HIGH-METHANE GAS (E) | 419 | 340 |

| CRUDE OIL and NGL in Norway ths tonnes |

2014 | 2013 |

|---|---|---|

| Production of crude oil and NGL | 418 | 283 |

| Sales of crude oil and NGL | 389 | 297 |

The Skarv field

Interests: BP Norge AS (23.8%) – operator, PGNiG UI (11.9%), Statoil Petroleum AS (36.2%), E.ON E&P Norge AS (28.1%).

The Skarv oil and gas field, covered by licences PL212, PL212B and PL262, was discovered in 1998, and took 13 years to achieve its current development stage. The field was developed together with the adjacent Idun field. In 2007 the Skarv and Idun field licences were consolidated into a single Skarv licence.

Skarv is located some 210 km west of the coast of Norway, where the water depth is approximately 350-450 m. The field was developed using a modern floating production, storage and offloading vessel (FPSO), suitable for operation in rough sea conditions, which was connected to a gas pipeline for exporting the output to European markets.

The remaining recoverable reserves of the Skarv field are estimated at approximately 6.8 m tonnes of crude oil, 3.9 m tonnes of NGL, and 30.5 bn m3 of gas (according to operator data as at 31 December 2014). In addition, together with its licence partners, PGNiG UI discovered additional reserves (e.g. Snadd North), to be developed using the existing facilities. The discovery increased the recoverable reserves remaining in the Skarv licence area by approximately 46%. PGNiG reserves in the Skarv licence area currently amount to 50.2 m boe.

The newly discovered Snadd North field is estimated to contain 9-16 bn m3 of natural gas (PGNiG Upstream’s interest is 11.9175%). In 2011, the licence partners drilled a production well in the Snadd field to appraise its quality and estimate its production potential. Long-term production tests of the well began in 2013 and will last to the end of December 2015. Their results will inform the decision on the further development of the field.

Licence PL212E

Interests: BP Norge AS (30%) – operator, PGNiG UI (15%), Statoil Petroleum AS (30%), E.ON E&P Norge AS (25%)

The PL212E licence area was separated from the Skarv area after a consolidation agreement was signed in 2007. The work programme for the licence was completed.

In 2012, the licence partners drilled an exploration well and discovered a new gas field in the PL212E licence area (Snadd Outer). The new field is located in the vicinity of the Snadd North gas field and adjoins the Skarv field. According to initial operator estimates, the Snadd Outer field’s recoverable reserves range between 2 and 4 bn m3 of natural gas.

The licence partners are completing a comprehensive evaluation of the Snadd Outer field reserves to facilitate their optimum development in the future.

The Gina Krog field

Interests: Statoil Petroleum AS (58.7%) – operator, PGNiG UI (8%), Total E&P Norge AS (30%), Det norske oljeseskap (3.3%)

The Gina Krog field (formerly called Dagny) was discovered by Esso in 1974. It is an oil and gas field located in the central part of the North Sea, 250 km west of Stavanger and 30 km northwest of Sleipner. The Gina Krog field development is among the most important projects of this type being carried out in Norway. Its plan for development and operation (PDO) assumes gross reserves of 225 m boe. According to Statoil’s plans, the field is to become an oil hub northwest of Sleipner. The PDO provides for placing on the field a new platform for initial treatment of hydrocarbons and a floating storage and offloading unit (FSO). The floating part of the platform is currently being constructed by Daewoo in South Korea. The platform will accommodate 20 wells, and its capacities will be 10,000 Sm3/day and 9 m Sm3/day in the case of gas injection/export, and 4,000 Sm3/day in the case of treatment of produced water.

The FSO unit, made by converting a shuttle tanker, will be used to store oil produced from the Gina Krog field. It is a stand-alone unit that can hold 860,000 barrels of oil. Oil will be exported via the North Sea using shuttle tankers. To enhance oil production, gas will be injected into the field. Gas for injection will be initially imported from Gassled. Produced gas is transported to the Sleipner centre, where it is separated and transmitted to the Gassled pipeline. Produced condensate is transmitted through Sleipner to Kårstø using an existing pipeline for transporting condensate.

The Vilje field

Interests: Det norske oljeselskap AS (46.9%) – operator, PGNiG UI (24.243%), Statoil Petroleum AS (28.8%)

The Vilje field is located within the boundaries of the 25/4 block in the Norwegian sector of the North Sea, approximately 20 km northeast of the Alvheim field and north of the Heimdal field. The sea depth in that area is 120 m. The reservoir rock is turbidite sandstone of Heimdal Formation, middle and late Palaeocene, found at the depth of 2,100 m. The Heimdal Formation is composed of unconsolidated, high-porosity sands with high net pay and permeability. The sandstone is subject to normal pressure, and the deposit is characterised by water-drive conditions.

The Vilje field has been developed through three subsea horizontal wells tied to the production unit. Hydrocarbons from the subsea wells are transmitted via a 19-kilometre pipeline for initial treatment on the Alvheim platform. Oil is transported from the platform by tankers.

The Vale field

Interests: Centrica Resources (Norge) AS (50%) – operator, PGNiG UI (24.243%), Lotos Exploration and Production Norge AS (25.8%)

Vale is a gas and condensate field situated 16 kilometres north of the Heimdal gas production facility. The field was discovered in 1991, and its development commenced in 2002. The sea depth in that area is approximately 114-120 m. The plan of development and operation for the Vale field provides for a single subsea well tied to the Heimdal platform. The field is not planned to be developed using pressure maintenance methods. This means that the field will be developed until natural depletion. In the south-west, the field adjoins a water-bearing formation whose drive stimulates production.

The Morvin field

Interests: Statoil Petroleum AS (64%) – operator, PGNiG UI (6%), Eni Norge AS (30%)

The Morvin field is located in the Norwegian Sea, in close proximity to other projects – approximately 20 km north of the Kristin field and 15 km west of the Åsgard B platform. The reservoir is 4,500-4,800 m under water surface, and the sea depth in the area is 360 m.

Morvin is an oil and gas field developed with four horizontal production wells and two subsea templates tied back to Åsgard B, a semi-submersible production platform with facilities for gas treatment and stabilisation of gas and condensate.

Licence PL558

Interests: E.ON E&P Norge AS (30%) – operator, PGNiG UI (30%), Det norske oljeselskap AS (10%), Petrolia Norway AS (10%), Petoro AS (20%).

The licence, awarded in the APA 2009 licencing round in early 2010, is located in the immediate vicinity of the Skarv field. The vicinity of the Skarv FPSO platform will ensure profitable gas and oil exports if hydrocarbons are discovered in the licence area.

In 2011 the existing 3D seismic was reprocessed and the licence was evaluated. In 2012, the licence partners decided to start drilling in the Terne Jurassic prospect. The Terne well was drilled, but in 2014 it was found to be dry and all capitalised expenditure related to the licence was written off in December 2014. The company decided to relinquish the licence in H1 2015.

Licence: PL646

Interests: Wintershall Norge AS (40%) – operator, PGNiG UI (20%), Lundin Norway AS (20%), and Noreco Norway AS (20%).

The licence was awarded in the APA 2011 licensing round. PL646 is located immediately to the south of the PL558 licence area, PGNiG’s main area of operations. The licence area contains a Jurassic prospect (Bogart) and a Tertiary lead (Bacall). Seismic surveys of the Bogart play reveal a floor reflection indicative of natural gas and formation fluid. The Company extended the deadline for completion of the field analysis, ultimately releasing it in December 2014, i.e. prior to the drill-or-drop decision due in February 2015. As the prospect and lead appear to be quite small, PGNiG will probably withdraw from the project. Consequently, all capitalised expenditure on operations within the licence area will be written off.

Licence: PL648S

Interests: PGNiG UI (50%) – operator and OMV (Norge) AS (50%).

The PL648S licence, acquired during the APA 2011 licensing round, is the first project in which the company acts as the operator. The licence area is located north-west of the Skarv field and covers shallow stratigraphy over the floor of Cretaceous formations. In 2014, the status of the Kraków play was downgraded from prospect to lead. At the same time, attempts were made to develop Warszawa, an older lead, and raise its status to that of a prospect suitable for drilling. However, as the size of the play was too small to warrant an economically viable decision to drill, the licence holders decided to relinquish the licence in November 2014. All capitalised expenditure on seismic surveys was written off in 2014.

Licence: PL702

Interests: OMV (Norge) AS (60%) – operator and PGNiG UI (40%).

The PL702 licence, awarded during the 22nd APA 2013 licensing round, is located within the Vøring basin of the Norwegian Sea. The licence is located some 120 km south-west of the Aasta Hansteen field, for which a permit approving production has been issued. The licence area contains Billing, a Cretaceous prospect, as well as several smaller leads within the same formation. Billing is a gas play with strong potential, largely similar to other gas fields in the region. In 2013 the licence holders obtained 3D seismic from the licence area, which they subsequently reprocessed and merged with data from the PL703 licence. Release of the analysis has been delayed − most likely its results will be released by the end of October 2015. A request was filed to extend the deadline for making a drill-or-drop decision until June 2016. The request has been approved by the relevant ministry.

Licence: PL703

Interests: OMV (Norge) AS (60%) – operator and PGNiG UI (40%)

The PL703 licence, awarded during the 22nd APA 2013 licensing round, is located within the Vøring basin of the Norwegian Sea. The licence is located some 80 km west of the Aasta Hansteen field, for which a permit approving production has been issued. The licence area contains Loki, a Cretaceous Campanian prospect, as well as several leads in Coniacian formations located within deeper layers. Seismic data on the Loki accumulation indicates a clear geophysical anomaly which, in this region, is mostly associated with the presence of natural gas. The licence holders reprocessed the data and merged it with data from the PL702 licence. Accelerated results of the analysis, which will be available in 2015, will enable the licence holders to make a drill-or-drop decision in June 2015. According to OMV’s preliminary findings, Loki may be suitable for drilling. In such a case, the decision to launch drilling could be taken as early as in mid-2015, even though the licence holders have time to decide until June 2016.

Licence: PL707

Interests: Edison Norge AS (50%) – operator, PGNiG UI (30%), North Energy AS (10%) and Lime Petroleum Norway AS (10%).

The PL707 licence, awarded during the 22nd APA 2013 licensing round, is located in the south-east of the Barents Sea, on the Finnmark Platform. The area is some 50 km off the coastline and 150 km east of the Goliat field. This section of the basin is considered to be an unsurveyed oil province. In the 1980s and 90s, only a few wells were drilled in the area, all with promising results. Apart from PL707, the only licence area in this region is PL708. The licence contains Mungo, a Permian prospect connected with carbonate structures (spiculite). Several other leads have been identified in the licence area within the same formation, with further leads visible in deeper layers of the Carboniferous formation. Seismic data on the Mungo play reveal a clear anomaly within its boundaries, indicating the presence of hydrocarbons. A well drilled in the licence area in the 1980s confirmed the existence of this accumulation. Work carried out in the area is on schedule, with the drill-or-drop decision due in June 2015. In 2015, Lundin drilled an exploration well in a similar accumulation located within the area of the nearby PL708 licence. The discovery of hydrocarbon deposits would allow Mungo to be classified as a prospect suitable for drilling.

Licence: PL711

Interests: Repsol Exploration Norge AS (40%) – operator, PGNiG UI (20%), OMV (Norge) AS (20%) and Idemitsu Petroleum Norge AS (20%).

The PL711 licence, awarded as part of the 22nd APA 2013 licensing round, is located in the south-west of the Barents Sea, within the Bjørnøyrenna basin, west of the Loppa uplift, and some 200 km off the coastline and 50 km east of the Johan Castrup zone, where hydrocarbon reserves have been discovered. This part of the basin is considered to be a vast and unsurveyed gas province. The licence area contains Labbetuss, a Tertiary Eocene prospect, as well as several Cretaceous leads. Following the reinterpretation of data, Labbetuss was reclassified as a diagenetic anomaly without commercial hydrocarbon reserves, and consequently exploration work focused on the Cretaceous plays. However, it is unlikely that a new drilling target will be identified in the course of the work. Consequently, a decision was made to write off all capitalised expenditure on seismic surveys performed in the PL711 licence area.

Licence: PL756

Interests: PGNiG UI (50%) – operator, Rocksource Exploration Norway AS (25%), Idemitsu Petroleum Norge AS (25%).

In January 2014 PGNiG UI was awarded a 50% interest in and the operatorship of the PL756 licence in the Norwegian Sea. PL756 is situated immediately to the southwest of the Heidrun field and east of the Smørbukk field. The licence contains the Reodor prospect, which is an amplitude supported hanging-wall trap in Jurassic strata. Younger Cretaceous leads are also present on the licence. Work will continue throughout 2015 to evaluate Reodor as a drilling candidate, prior to the drill-or-drop decision due in February 2016. Higher quality seismic data covering the licence area will be purchased in January 2015 to improve the prospect imaging.

Licence: PL 799

Interests: PGNiG UI (40%) – operator, Statoil Petroleum AS (20%), VNG Norge AS (20%), Explora Petroleum AS (20%).

In January 2015 PGNiG UI was awarded a 40% interest in and the operatorship of the PL799 licence in the Norwegian Sea. PL799 is situated immediately to the west of the Skarv field. The licence contains the Toruń prospect, located with the Lysing formation, and the Warszawa South lead within the Lange formation.

The migration of hydrocarbons into the prospects is the main risk, which will be addressed using the latest Geostreamer 3D seismic data. The drill-or-drop decision is to be made within two years from the award of the licence (no later than in Q1 2017).

Licenses outside Europe

Pakistan

PGNiG conducts exploration work in Pakistan under an agreement for hydrocarbon exploration and production in the Kirthar licence area executed between PGNiG and the government of Pakistan on 18 May 2005. Work in the Kirthar block is conducted jointly with Pakistan Petroleum Ltd., with production and expenses shared in proportion to the parties’ interests in the licence: PGNiG (operator) – 70%, Pakistan Petroleum Ltd. – 30%.

On 6 July 2012 the Pakistani licensing authority (Directorate General of Petroleum Concessions) classified the Rehman field as a deposit of unconventional tight gas. As a result, the interest holders can raise its prices by 50% relative to prices of gas produced from conventional reserves.

In 2012 PGNiG decided to move on to the second exploration stage on the Kirthar licence, as part of which new exploration wells are to be drilled. In 2013 the construction of pipelines and provisional surface installations was completed and test production from the Rehman-1 and Hallel X-1 wells began.

In 2014 PGNiG began preparations to drill appraisal boreholes Rehman-2 and Rehman-3 (scheduled for 2015 and 2016). PGNiG had to declare a force majeure event and suspend work on the Rizq-1 exploratory well on two occasions, due to armed attacks in the region. Work on Rizq-1 was resumed in late December 2014. Production from the Rehman-1 and Hallel X-1 wells

| NATURAL GAS PRODUCTION in Pakistan m m3 |

2014 | 2013 |

|---|---|---|

| NITROGEN-RICH GAS (Ls/Lw as E equivalent) | 58 | 25 |

| SALES OF NATURAL GAS in Pakistan m m3 |

2014 | 2013 |

|---|---|---|

| NITROGEN-RICH GAS (Ls/Lw as E equivalent) | 57 | 25 |

Libya

In February 2008 POGC Libya signed an Exploration and Production Sharing Agreement (EPSA) with the National Oil Corporation of Libya, authorising the company to carry out exploration work on Exploration and Production Licence No 113 with an area of 5.5 thousand km2. The licence is located within the Murzuq petroleum basin in western Libya.

In performance of its exploration commitments in Libya, the company has so far acquired over 3,000 km of 2D seismic data and over 1,000 km2 of 3D seismic data. Two exploration wells have also been drilled and rendered positive results, as confirmed by the National Oil Corporation.

Due to the tense political situation and growing threat to the safety of employees, the exploration work in Libya was discontinued in January 2014.

Geophysical, geological and drilling services provided abroad

In foreign markets, the Group performed seismic acquisition work and well logging services for customers from Hungary, Germany, Slovakia, Serbia, Tunisia, Oman, Georgia and other countries, as well as seismic data processing and interpretation services for customers from Pakistan, France, Yemen, the United Kingdom, Kenya, Cameroon and other countries.

As regards specialist well services performed abroad, the companies’ operations included cementing services in Romania and Lithuania, coiled tubing, nitrogen unit operations and mud logging in Ukraine, as well as well workovers and well abandonment services in the Czech Republic.

On foreign markets, drilling was conducted in exploration for conventional hydrocarbons for third-party customers, including in Uganda, Ethiopia, Pakistan, Kazakhstan, Egypt and Lithuania. In addition, the segment carried out contracts for production well drilling, which were primarily performed in Poland for PGNiG, and abroad for third-party customers – mainly in Kazakhstan, Pakistan and Ukraine.

Environmental protection

Well and extraction pit abandonment

Pursuant to the Geological and Mining Law, PGNiG is required to properly abandon worked-out extraction pits, eliminate the danger and repair any damage caused by mineral extraction, and restore the land to its original condition. The plugging of wells and pits prevents any leakage of crude oil and natural gas to the surface and to water courses. Furthermore, if gas wells remain unplugged, there is a risk that escaping gas could accumulate, posing a fire hazard. In 2014 plug and abandonment operations were performed on a total of 45 wells and 34 extraction pits.

Carbon emissions trading scheme

In 2014 the Zielona Góra Branch and the Odolanów Branch, the Mogilno Underground Gas Storage Cavern Facility, the LMG crude oil and natural gas production facility, Wierzchowice Underground Gas Storage Cavern Facility, and Kosakowo Underground Gas Storage Cavern Facility were covered by the carbon dioxide emissions trading scheme (ETS). In 2014 CO2 emissions from these installations reached 146.6 thousand Mg. The amount will be verified by an accredited verifier by 31 March 2015. In 2014 PGNiG reviewed annual reports on its carbon dioxide emissions for 2013. Carbon emissions from the installations covered by the EU ETS scheme in 2013 totalled 84.9 thousand Mg. After reconciling its CO2 emissions with emission rights held, and after redeeming the allowances allocated for 2013, a deficit of 23.8 thousand Mg CO2 was identified. The deficit was covered with reserve allowances accumulated in the accounts of PGNiG’s installations (unused free allocations from previous years) and with allowances purchased on the Intercontinental Exchange Futures Europe.

In the current trading period (2013-2020), the free allocation of CO2 emission allowances covers only part of the actual emissions. The free allocations will be phased out, reaching zero in 2027.

Land reclamation and non-productive asset surveying

Pursuant to the Environmental Protection Law, PGNiG conducts evaluation and land reclamation work in areas that have become polluted in the course of its earlier operations (including those related to traditional gas production), with a view to restoring them to a condition prescribed by environmental quality standards. In 2014 no land reclamation work was conducted in polluted areas. We also monitor the soil-water environment of the reclaimed landfill site in Zabrze-Biskupice, and a property in Zabrze. In 2014 the Environmental Protection Division prepared documents for the proceedings to contract land reclamation services concerning polluted properties in Czersk, Reszel and Szprotawa. At present, the unit responsible for organising tenders for land reclamation services is the Administration and Asset Department.

REACH and CLP

In 2014 PGNiG was supervising compliance of its subcontractors using chemical substances for well treatments with the regulations of the European Parliament and of the Council of the European Union on the safe use of chemicals (REACH) and on the classification, labelling and packaging of substances and mixtures (CLP). The Company also drew up contractual provisions, to be included in its hydraulic fracturing, mud and cementing service agreements, concerning the use of chemical substances and mixtures, which would facilitate the control of related hazards and ensure compliance with all requirements imposed by Polish and EU laws.

Environmental protection in drilling operations

Drilling work performed as part of exploration for and production of hydrocarbons has an impact on the environment in the immediate vicinity of the site where it is carried out (the affected area for one borehole is approximately one hectare). Drilling operations cause a temporary change in the character of the land, increased emissions of gases and exhaust fumes, higher noise intensity and generation of waste.

In order to protect the land surface, the upper layer of soil is stripped off to be used later for land reclamation. A drilling rig is installed on tightly insulated ground. Diesel oil tanks and receptacles for waste and hazardous substances are placed in special containers. Drilling muds are made from chemical substances and mixtures meeting the requirements of the Polish and EU law (including the Chemical Substances and Mixtures Act (J.L. of 2011, No 63, item 322) as well as the REACH and CLP Regulations. Besides water (about 25%), organic components (polymers) are the largest mud additives by weight. All waste generated in connection with borehole drilling or human presence on the drilling site is collected in tightly-sealed vessels and transferred to authorised waste management operators.

Emissions of gases and exhaust fumes into the atmosphere are limited by maintaining the drilling rig engines in excellent operating condition and using quality fuel to run the engines. Repeated surveys of the quality and quantity of pollutant emissions into the air and of their distribution patterns have shown that all air pollutant concentration standards are met in the areas where drilling work is conducted.

Noise intensity is reduced by using machinery and equipment that produce less noise, and if the noise emission standards are exceeded, means of acoustic protection are used, such as screens installed to shelter the pipe ramp and pipe rack on drilling rigs.

Special devices are used to minimise the volume of drilling waste, for instance through drilling mud recycling (screens on shale shakers, centrifuges, desilters and desanders). On the other hand, the volume of waste generated in connection with the operation of drilling equipment is limited through the use of modern long-life engine, gear and lubricating oils. The application of the highest quality fuels in the latest generation power generators protects filters against excessive fouling, which prolongs their useful lives. End-of-life filters are hazardous waste. Waste generated on a drilling site is stored in a manner ensuring the protection of the environment and of human health. Stored waste is pre-sorted. All waste storage sites are appropriately marked and under constant surveillance.

In 2014 expenditure incurred by Exalo Drilling to mitigate the impact of its drilling operations on the environment amounted to approximately PLN 16.68m. The funds were spent mainly on projects designed to reduce the volume of drilling waste and limit emissions into the environment, for instance by providing drilling rigs with modern power generators, fuel tanks, shale shakers, mud tanks and waste receptacles, and putting in place a mobile evaporator system enabling waste neutralisation. By equipping its drilling rigs with modern equipment, the PGNiG Group is able to meet the applicable technical and environmental standards.

Planned activities in 2015 and beyond

Exploration in Poland

In 2015 PGNiG will carry out exploratory geophysical work and drilling in Poland on a number of prospects in the Carpathian Mountains, Carpathian Foothills and the Polish Lowlands. The work will be conducted by PGNiG on its own or jointly with partners.

The Company also intends to pursue projects focused on exploring new potential opportunities, where little appraisal has so far been made. In Pomerania, three horizontal wells will be drilled and fracked. PGNiG also plans to drill two exploratory wells into Carboniferous formations, which are a new direction of its hydrocarbon exploration.

Exploration abroad

In Pakistan, in order to verify the potential of the structure located to the north of the Kirthar discovery, PGNiG will continue drilling the Rizq-1 well and perform further work on the Rehman-2 and Rehman-3 wells.

On the Norwegian Continental Shelf, PGNiG UI, as a project partner, will continue to produce hydrocarbons from the Skarv field and the newly acquired fields, proceed with the development of the Snadd and Gina Krog fields, and prepare for the second stage of the drilling campaign on the Skarv field. In addition, PGNiG UI intends to acquire new licence areas by participating in annual licensing rounds and by acquiring interests from other entities. In the future, the company may participate, as a partner, in drilling projects in deep-sea waters (below 1 thousand metres) and in the Arctic Zone. This is connected with its interests in two licences (PL702 and PL703) within the Vøring Basin in the Norwegian Sea shelf, where the sea depth exceeds 1 thousand metres, and in two licences (PL707 and PL711) in the Barents Sea shelf, in the Arctic Zone.

Natural gas and crude oil production

The PGNiG Group is implementing an investment programme aimed at maintaining its natural gas production capacity in a long-term perspective. As part of the programme, PGNiG plans to develop new deposits and wells, modernise and expand the existing gas production facilities, build new underground gas storage facilities and expand the existing ones.

Plans for 2015 provide for a natural gas production volume of approximately 4.5 bn m3 of high-methane gas equivalent with a calorific value of 39.5 MJ/cm, of which 0.4 bn m3 will be produced from fields on the Norwegian Continental Shelf. Within the Sanok Branch area, plans for 2015 include launch of production from two wells on the Przemyśl producing field, as well as launch of production from the new Załęże field. Within the Zielona Góra Branch area, it is planned that in 2015 production will be launched from new wells on the Daszewo, Zaniemyśl and Wilków fields.

The PGNiG Group estimates its 2015 crude oil output at 1.27 m tonnes, including 0.76 m tonnes produced domestically, and 0.51 m tonnes produced from fields on the Norwegian Continental Shelf.

Service activities

In 2015, the PGNiG Group will provide drilling services in Poland and abroad. In Poland, the segment companies will conduct drilling for PGNiG and for third-party customers. In foreign markets, services will be provided for PGNiG in Pakistan and for third-party customers in Egypt, Kazakhstan, Pakistan, Saudi Arabia, Botswana, the Czech Republic, Lithuania, and Ukraine.

Specialist oilfield services are planned to be performed in Poland chiefly for PGNiG, but also for foreign companies that hold licences to explore for minerals (mainly hydrocarbons), and in foreign markets for third-party customers in Croatia, Romania, the Czech Republic, Saudi Arabia, Ukraine, Lithuania, Belarus and other countries.

The segment will also provide seismic data acquisition, processing and interpretation services to PGNiG and third-party customers (including FX Energy Poland Sp. z o.o. and Orlen Upstream Sp. z o.o.). Abroad, the PGNiG Group will render geophysical services in Tunisia, Oman, Pakistan, Kenya, Cameroon, Yemen, India, Georgia and EU member states (the Czech Republic, Slovakia, Austria, Germany, Denmark, Hungary and Croatia).

KRS 0000059492, NIP 525-000-80-28, kapitał zakładowy 5 900 000 000 zł – opłacony w całości

Centrala Spółki ul. M. Kasprzaka 25, 01-224 Warszawa

tel.: +48 22 589 45 55, faks: +48 22 691 82 73