PGNiG is the largest importer of natural gas into Poland.

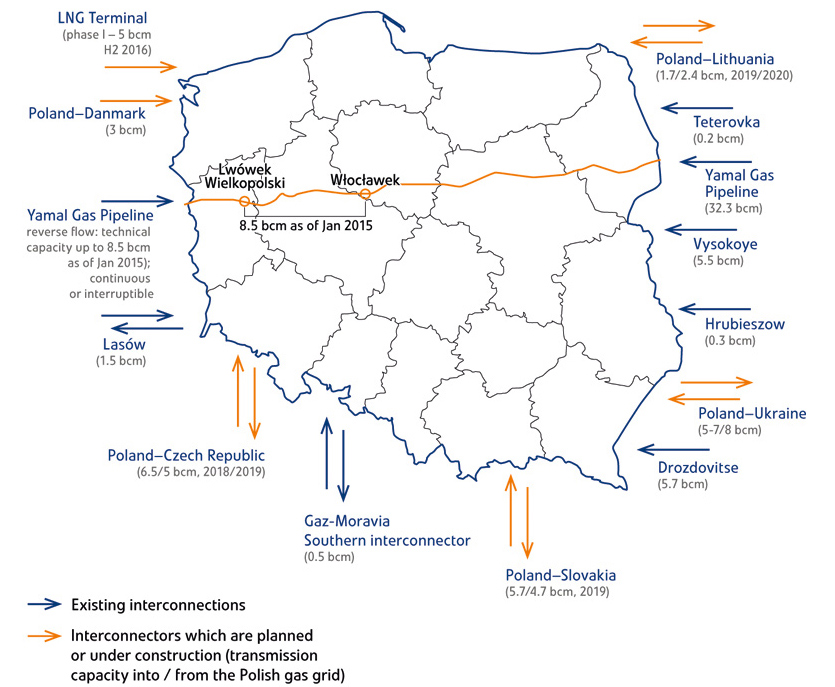

The existing gas infrastructure makes it possible to import natural gas from the following directions:

On January 1st 2015, OGP Gaz-System SA added new technical capacities for importing gas to Poland from across its western border using the virtual reverse flow service on the Yamal gas pipeline. It became possible as a result of extension of the Włocławek entry point. At present, gas may be imported to Poland through the Mallnow-reverse point on a continuous basis at a rate of up to 5.5 billion cubic metres per annum.

In addition, transmission capacity at the Mallnow-reverse point is offered on an interruptible basis, which makes it possible to import an additional 2.7 billion cubic metres of gas per annum if the Yamal gas pipeline is delivering gas to Germany.

The system connections (the Lasów terminal and the interconnector with the Czech Republic, near Cieszyn, commissioned in 2011) enable free trade flows between countries of the European Union, strengthening economic integration among the EU member states. Development of the interconnector infrastructure has also significantly improved Poland’s energy security, providing a potential source of emergency supplies.

In addition, Polskie LNG SA (a wholly-owned company of OGP Gaz-System SA) is in the process of starting up the LNG terminal in Świnoujście. In the initial phase, the terminal’s capacity will amount to 5 billion cubic metres of gas. PGNiG has been involved in the terminal start-up and cooling process. In order to procure LNG for the process, PGNiG entered into a contract for two LNG shipments with Qatargas Operating Company Limited (acting on behalf of Qatar Liquefied Gas Company Limited (2)) and a contract to sell these LNG volumes to Polskie LNG SA.

The first of the LNG shipments was delivered to the Świnoujście terminal in December 2015, and the second one arrived in February 2016. In January 2016, PGNiG, OGP GAZ-SYSTEM SA and Polskie LNG SA began testing the delivery of gas from the LNG terminal into the Polish transmission system.

The volume of gas received under the Yamal Contract in 2015 was lower than in previous years, due to temporarily reduced supplies. In spite of that, throughout the period of limited gas supplies, the stability of gas supplies to PGNiG’s customers was not affected and the Company did not default under its contractual obligations towards customers.

In 2015, the bulk of high-methane and nitrogen-rich natural gas sold by PGNiG was subject to regulatory price control (only high-methane gas traded at the Polish Power Exchange (TGE) was not subject to regulatory approval of tariffs).

Natural gas trading (other than at the TGE) is subject to regulation by the President of the Energy Regulatory Office, who approves gas fuel tariffs, including the underlying prices of gas fuel and fees, and oversees their application for consistency with the provisions of the Polish Energy Law. The tariff approval process involves an analysis of costs which are considered reasonable by energy companies and are relevant for the calculation of the prices and fee rates included in tariffs. Notwithstanding the Company’s obligation to sell a portion of its gas volumes through the exchange market, tariffs have a significant effect on the Company’s financial performance. The methodology used to determine tariffs is based on an analysis of forecast costs and planned sales volumes of both domestically produced and imported gas.

Gas fuel is supplied to customers connected to the transmission network and the distribution network under comprehensive service contracts, which are settled based on a tariff specifying:

In 2015, the following Gas Fuel Tariffs were in place:

Furthermore, on December 16th 2015, by virtue of a relevant decision, the President of the Energy Regulatory Office approved Gas Fuel Supply Tariff No. 9/2016, which was effective from January 1st 2016 until March 30th 2016, reducing the average prices of high-methane and nitrogenrich gas by 6.6% and by 6.1%, respectively.

In May 2015, PGNiG launched the ‘Price Deregulation’ discount scheme for its strategic customers, in response to customer expectations and as a reaction to intensified competition and evolution of the gas market. The discount scheme covered gas purchased between May 1st 2015 and December 31st 2015. The scheme was voluntary, and customers who opted out continued to pay for gas according to PGNiG’s then effective tariff. Those opting for the scheme received a discount on the tariff price, which was indexed to prices at the Polish Power Exchange and depended on the offtake volumes and stability. The highest discounts were offered to customers off-taking large volumes of gas at stable rates. As a condition for joining the scheme, customers had to submit relevant declarations and collect at least 80% of the previously ordered gas volumes.

The ‘Price Deregulation’ discount scheme proved very popular, attracting more than 30 of PGNiG SA’s strategic customers, whose aggregate orders account for 85% of the total gas volume sold by the Company.

On July 1st 2015, PGNiG launched the 2015/2016 edition of the ‘Price Deregulation’ scheme. The scheme covers gas purchased between August 1st 2015 and the earlier of December 31st 2016 or the date when PGNiG is released by the President of the Energy Regulatory Office from the obligation to submit gas tariffs for regulatory approval. Just like in the previous edition, participation in the scheme is voluntary and customers receive a discount on the tariff price. Key differences include: the rules of settling the minimum offtake obligation, option to obtain fixed or indexed prices (indexed to the price of an exchange-traded product selected by the customer), and introduction of ‘flexible’ and ‘base’ products.

Given the introduction of the discount schemes and execution by PGNiG customers of new agreements with individual pricing terms, at the end of 2015 most of the high-methane gas grid volumes were sold by the Company at market prices.

In 2015, PGNiG continued to actively trade at the Polish Power Exchange. The Company continued to generate a vast proportion of futures and spot trading, and contributed to improving the liquidity of the exchange market. Given the stable trading at the TGE, the exchange market was one of the key sales channels for the Company.

Since November 2013, PGNiG has also continuously acted as a Gas Market Maker at the Polish Power Exchange, committing to regularly place buy and sell orders on the gas futures market. The key role of a market maker is to enhance the market’s liquidity and transparency.

In exchange trading, both the selling and the buying party remain anonymous. This results in prices being set at the market level, or a level at which supply matches demand.

In 2015, the structure of monthly trading volumes at the TGE changed considerably compared with the previous year. One of the key reasons was that 2015 was the first full year of the activity of PGNiG Obrót Detaliczny, which had launched its operations in August 2014 to become one of the key operators purchasing gas through TGE markets.

The chart below presents monthly trading volumes at the gas exchange in 2014-2015. Trading is dominated by the Commodity Futures Instruments Market (CFIM), which is used to hedge positions in the medium and long term. The Day-Ahead Market (DAM) and the Intraday Market (IDM) are used to balance short-term positions.

The separation of retail trading has contributed to a significant shift in sales channels. To a large extent, transactions executed on the power exchange have replaced bilateral contracts. 2014 saw trading volumes soar in the period from August until the end of the year, following spinoff of the retail trading company. In 2015, trading volumes were spread more evenly throughout the year. Concurrently, there was a noticeable increase in trading volumes on the Day-Ahead Market compared with the previous year.

| jan | feb | mar | apr | may | jun | jul | aug | sep | oct | nov | dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RDNg 2015 [bcm] | 38 | 24 | 23 | 38 | 26 | 17 | 4 | 8 | 10 | 43 | 43 | 39 |

| RDBg 2015 [bcm] | 51 | 50 | 71 | 160 | 56 | 47 | 41 | 35 | 52 | 130 | 123 | 140 |

| RTTg 2015 [bcm] | 945 | 1 055 | 975 | 497 | 430 | 584 | 1 406 | 667 | 575 | 430 | 337 | 572 |

| RDNg 2014 [bcm] | 4 | 1 | 3 | 12 | 7 | 8 | 13 | 63 | 53 | 109 | 112 | 105 |

| RDBg 2014 [bcm] | - | - | - | - | - | - | - | 11 | 7 | 19 | 32 | 39 |

| RTTg 2014 [bcm] | 38 | 30 | 49 | 53 | 125 | 280 | 478 | 2 630 | 2 254 | 2 059 | 1 227 | 632 |