Preliminary estimates of Gross National Product (GDP) published by the Central Statistics Office of Poland indicate that in 2015 the Polish economy grew by 3.6%. This rate of growth is 0.3 pp higher compared with 2014, placing Poland among the seven fastest growing EU economies.

An important factor affecting GDP growth in 2015 was a robust household consumption growth of 3.1%, up 0.5 pp on 2014, and a positive foreign trade balance. Relative to the previous year, growth rates of the other GDP components, i.e. domestic demand and investments, were less remarkable, reaching 3.4% (down from 4.9%) and 6.1% (down from 9.8%), respectively.

In 2015, the EU average GDP growth rate was 1.9%, just above market expectations. Low interest rates and a decline in commodity prices suppressed the inflation rate. Of particular importance to European economies was a sharp fall in crude oil prices in the second half of 2015, causing an increase in real household incomes. This boosted private consumption, which became the main engine driving economic growth across the EU. Internal demand compensated for negative external factors, such as signs of a slump in the economies of China and developing countries, as well as a decline in global trade flows.

| 2013 [%] | 2014 [%] | 2015 [%] | |

|---|---|---|---|

| Bulgaria | 13 | 15 | 30 |

| Croatia | -11 | -04 | 16 |

| Czech Republic | -05 | 20 | 42 |

| Estonia | 16 | 29 | 11 |

| Lithuania | 35 | 30 | 16 |

| Latvia | 30 | 24 | 27 |

| Poland | 13 | 33 | 36 |

| Romania | 35 | 30 | 38 |

| Slovakia | 14 | 25 | 36 |

| Slovenia | -11 | 30 | 29 |

| Hungary | 19 | 37 | 29 |

| EU (28 countries) | 02 | 14 | 19 |

In 2015, wholesale gas prices were relatively stable in the first half of the year, to plummet in the other half of the year. As a result, end-of-year prices on Western European wholesale markets were lower by over a fifth and, on the Polish Power Exchange (TGE) − by over a fourth, compared with prices from early 2015.

The decline in gas prices recorded in 2015 was partially attributable to weaker consumption in the EU, which in turn was chiefly due to high temperatures, lower demand for gas in the industry and a resulting increase in stock levels. Prices were also held down by announcements of LNG supplies from the USA and the Middle East. Nevertheless, Russia and Norway, whose price formulas are largely tied to crude oil prices, still remain the main suppliers for EU countries. Consequently, the falling crude oil prices in 2015 had a significant bearing on gas prices in both Poland and Western Europe.

Over 42% of natural gas supplied to Europe last year originated from Russia (2014: 44%). Norway was the second largest exporter of gas to Europe in 2015, accounting for nearly 30.5% of total deliveries, 4% less than in 2014. On the other hand, 2015 saw volumes of gas imported from northern Africa and LNG imports grow by 11% and 15%, respectively.

The average daily withdrawal of gas from Polish storage facilities in Q1 2015 amounted to 7.6 million cubic meters, compared with only 3 million cubic metres in 2014. As at March 31st 2015, Polish storage facilities were filled to 47% of capacity, which means they held approximately 1.2 billion cubic metres of gas. The withdrawal of gas from storage was slower than in Europe – as at the end Q1, European storage facilities were filled to 26% of capacity. In Poland, regular injections of gas into storage started in May, a month later than in most European countries. Until mid-October, when gas volumes in storage reached maximum levels, Poland’s gas stocks were rising by a daily average of 0.3%, on par with the EU average.

From September 2014 to the end of February 2015, there were unexpected reductions in the supply of gas from Russia to Europe, including Poland, under the Yamal contract. This led to a growing divergence in gas prices between the Polish and German markets – from the typical level of approximately PLN 5/MWh to over PLN 20/MWh. On the back of increased gas demand typical of the winter period, significantly higher prices on TGE relative to TTF were recorded, as well as a growth in auction premiums charged at auctions of transmission system operators. As additional transmission capacities for imports from Germany were made available by OGP Gaz-System S.A. in Q1 2015 and supplies from across Poland’s eastern border returned to normal levels, prices quoted on TGE and European exchanges realigned. In early March, the spread between Polish and western gas markets narrowed down, to oscillate around PLN 5/MWh towards the end of the year.

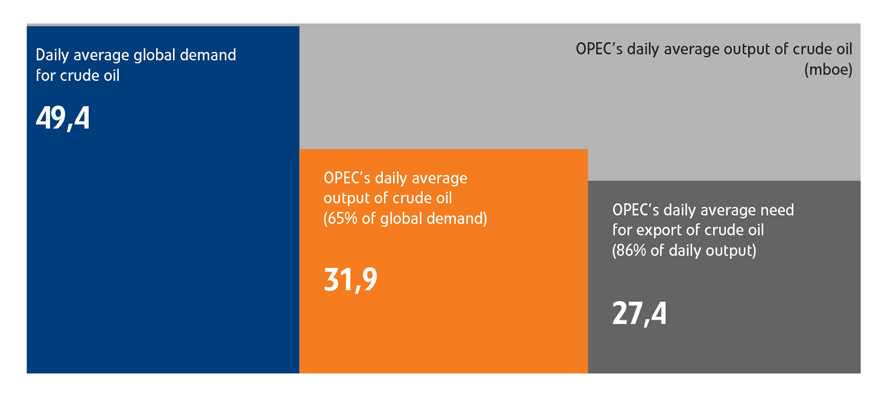

In 2015, crude oil prices continued on the downward trend started a year earlier, due mainly to waning demand from developing Asian markets. The average global demand for crude oil in 2015 declined slightly compared with 2014, to 49.4 million barrels per day.

Dwindling demand was largely linked to a declining GDP growth in China (down from 7.4% in 2014 to 6.9% in 2015), whose share in global crude oil consumption is estimated at 12%, coupled with announcement of plans to phase out the resource-intensive industrial economy model focused on export.

At the same time, the world’s major oil exporters maintained or even increased output, prompted mainly by OPEC’s policy to ramp up oil production with the aim of stifling the shale gas revolution in the USA and grab a larger share of global exports. In 2015, OPEC’s average daily output of crude oil was 31.9 million barrels, meaning that on average the cartel produced 4.5 million barrels per day in excess of their export needs. As a result, from January to December 2015, OPEC’s crude oil stocks went up from 2.6 billion to nearly 3 billion barrels.

In late 2015, crude oil price reductions accelerated with the price of Brent crude averaging at USD 39 per barrel in December, on Iran’s announced comeback to the global oil market.

In 2016, gas prices in Poland and the remaining European markets should be lower than in the previous year, held down mainly by the oil price slump. Another factor was the fairly mild winter, which led to the relatively slow withdrawal of gas from European storage facilities. Moreover, the market does not perceive an increased risk of reductions in gas supplies to Europe due to geopolitical reasons. Towards the end of 2015, the market price of gas with delivery scheduled for 2016 was just over EUR 15/MWh. Falling gas prices on European markets will be reflected in low gas prices on the Polish wholesale market, which is strongly aligned with its Western European counterpart. Another factor which may affect gas prices in Poland will be the commercial launch of the Świnoujście LNG terminal, slated for mid-2016. It will help diversify the sources of gas imports to Poland, from Qatar and other directions. Towards the end of the year, the market in Poland valued natural gas with delivery in 2016 at a little over PLN 72/MWh.

Iran’s impeding return to the market and no indications that oil-producing countries might decide to reduce their output are factors suggesting that prices will remain low in 2016. As at the end of 2015, the market valued futures contracts for delivery of oil in 2016 at USD 41/bbl.

Due to economic sanctions and restrictions on oil exports to western countries over the last four years, Iran’s only export direction was Asia, where it delivered approximately 0.9 million barrels per day. As sanctions are lifted, Iran is expected to up its production to 3 million barrels per day by the end of Q1 2016. In addition, Iran has oil stocks estimated at 40 million barrels, which can be readily supplied to the market.

Early 2015 saw a weakening of the euro against the złoty. Signals of Poland’s stable economic growth coincided with the ECB’s decision to initiate a bond purchase programme (quantitative easing). However, in the second half of the year, the European currency steadily appreciated. The end to the Greek crisis and economic downturn in China prompted investors to withdraw from developing countries, including Poland. In late December, the EUR/PLN exchange rate returned to the levels seen at the beginning of the year. An improvement in the US economy and expectations that Federal Reserve will raise interest rates triggered a major appreciation of the US dollar against the złoty. As at the end of 2015, the USD/PLN exchange rate rose by 11.2%, to PLN 3.9.