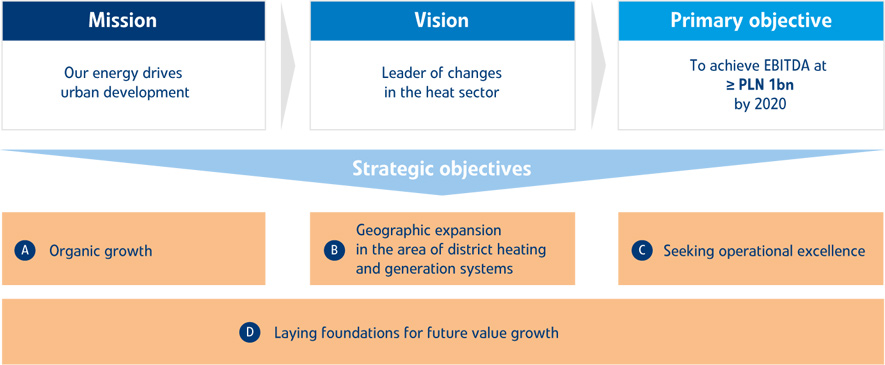

In November 2015, the Management Board of PGNiG accepted information on PGNIG TERMIKA’s strategy until 2022. As part of the now completed strategy operationalisation process, PGNiG TERMIKA defined its operational plans and identified tasks and people responsible for their delivery for all initiatives outlined in the strategy. PGNiG TERMIKA’s strategy until 2022 is a natural extension of the PGNiG Group strategy for 2014–2022 and a response to market risks and challenges the company is expected to face in the years to 2022.

Confronted with a number of challenges in its market and regulatory environments, PGNiG TERMIKA needs to implement a modernisation programme to meet new environmental requirements and raise its production potential. The company has also identified new business opportunities, which can be exploited to grow its value and expand its presence to markets beyond Warsaw. The company will take proactive steps towards geographical expansion, which it intends to achieve through heating network acquisitions and development of generation operations outside Warsaw. The company will seek to grow its value by implementing capital investment programmes focused on building new cost-efficient capacities powered by a diversified mix of fuels and on retrofitting existing generation sources with low-emission technologies. The company has identified strategic and operational initiatives within its strategic action areas.

The initiatives to be implemented over the time horizon defined in the strategy are to:

Capital expenditure planned for the coming years will be spent on funding business growth, environmental compliance and asset upgrades. The key business expansion projects will include construction of a CCGT unit at the Żerań CHP plant (scheduled for completion in 2019) and conversion of the K1 boiler at the Siekierki CHP plant to biomass co-firing (scheduled for completion in 2016).

The most important environmental protection projects will include construction of FGD and SCR units at the K2 boiler in the Siekierki CHP plant (scheduled for completion in 2017), implementation of a flue gas denitrification programme for water tube boilers at the Siekierki CHP plant, and modernisation of dust collectors in the KFA and KFB fluidised bed boilers at the Żerań CHP plant (scheduled for 2013−2016).

Key asset upgrade expenditures will include projects to modernise boilers at the Wola heating plant, the Pruszków CHP plant, boilers and turbine generation sets at the Siekierki CHP plant, switchgears, process systems and pressure components, as well as capitalised turnarounds at the Żerań and Siekierki plants.