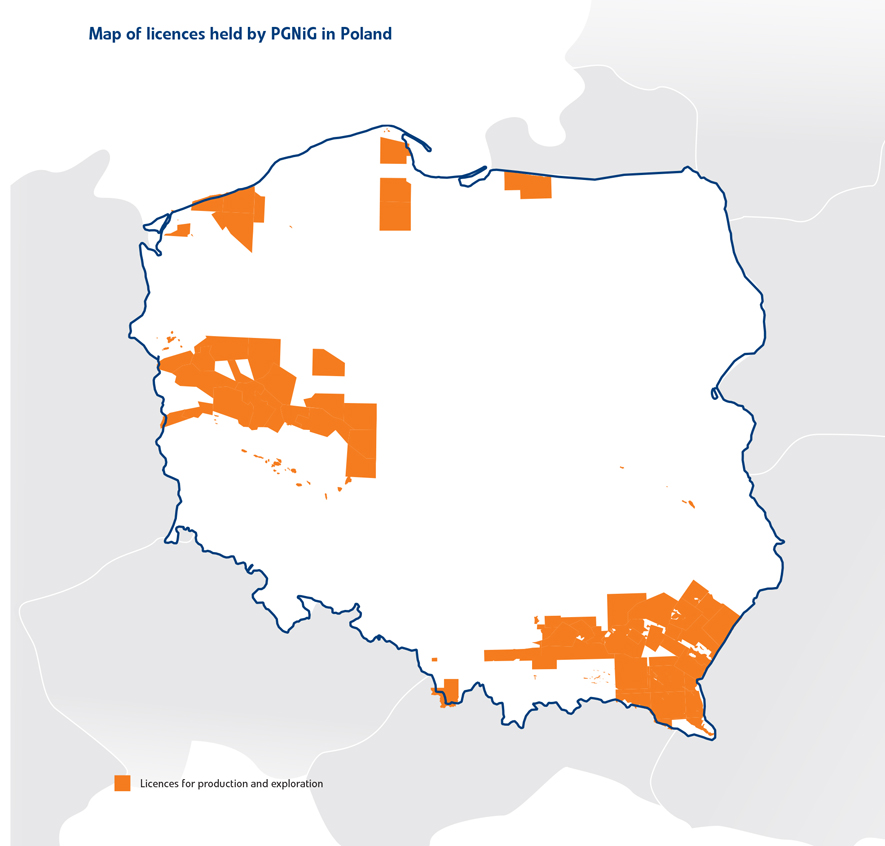

The PGNiG Group is the leader of the Polish hydrocarbon exploration and production market. Since 1990, hydrocarbon exploration in Poland has been based on a licensing policy which ensures equal access to exploration licences for all market participants. As at December 31st 2015, PGNiG held 61 licences for exploration and appraisal of crude oil and natural gas deposits. Over the past 25 years, a number of foreign companies have carried out exploration in Poland, including such global majors as Amoco, Texaco, Conoco and Exxon. New exploration companies were also established by Polish incumbents, i.e. PKN Orlen and Grupa LOTOS. At the end of 2015, 14 companies were engaged in hydrocarbon exploration in Poland. Despite this highly competitive environment, the PGNiG Group has maintained its leading position − no foreign company has independently made a material discovery or become the operator under a production licence. At the end of 2015 PGNiG held 227 production licences, i.e. approximately 96% of all licences for the production of crude oil and natural gas. There are also a number of international companies – such as Schlumberger, Halliburton, Weatherford and United Oilfield Services – offering oilfield services in Poland. Despite the intense competitive pressure, PGNiG Group companies (GEOFIZYKA Kraków, GEOFIZYKA Toruń and Exalo Drilling) enjoy a strong position in this market area.

In 2015, PGNiG was involved in crude oil and natural gas exploration and appraisal projects in the Carpathian Mountains, Carpathian Foothills and Polish Lowlands, both on its own and jointly with partners. Drilling work in areas covered by the licences awarded to PGNiG was performed on 26 wells, including 13 exploration wells, 3 research wells and 10 appraisal wells. In 2015, 11 wells were drilled with positive results, including 2 exploration boreholes in Polish Lowlands, 4 exploration boreholes and 5 appraisal boreholes in Carpathian Foothills. 9 wells failed to yield a commercial flow of hydrocarbons and were abandoned.

As at December 31st 2015, PGNiG’s recoverable reserves were:

In 2015, PGNiG was engaged in joint operations with other entities in licence areas awarded to PGNiG, FX Energy Poland Sp. z o.o., San Leon Energy PLC, LOTOS Petrobaltic S.A., and ORLEN Upstream Sp. z o.o. Furthermore, PGNiG was collaborating with other entities on exploration work in Pakistan and Norway.

Polish Oil and Gas Company - Libya B.V., the Group’s subsidiary, conducted exploration work in licence area No. 113 within the Murzuq petroleum basin in Libya, under an exploration and production sharing agreement of February 25th 2008 concluded with the Libyan government.

In the performance of its exploration commitments in Libya, the company has so far acquired over 3,000 km of 2D seismic data and over 1,000 km2 of 3D seismic data. Two exploration wells have also been drilled and rendered positive results, as confirmed by the National Oil Corporation. The second phase of 3D seismic work (almost 500 km2) and the drilling of six exploration wells are yet to be completed.

Due to the tense political situation and growing threat to the safety of employees, the exploration work in Libya was discontinued in January 2014. In March 2014, NOC signed a second prolongation agreement, extending the term of the EPSA by a total of 830 days.

On August 4th 2015, PGNiG acquired a licence interest from Central European Petroleum Gmbh and became party to a joint operations agreement concerning a subdivision of a licence area in eastern Germany (Brandenburg). The joint operations relate to oil and gas exploration, appraisal and production. PGNiG acquired a 36% interest in future revenue from the potential production of crude oil and natural gas. PGNiG’s project partners are Central European Petroleum Gmbh (39% interest and operatorship) and Austria’s Rohöl-Aufsuchungs AG (25% interest). In December 2015, work began on the Markische Heide-1 exploration well.

PGNiG is engaged in exploration work in Pakistan under an agreement for hydrocarbon exploration and production in the Kirthar licence area executed between PGNiG and the government of Pakistan on May 18th 2005. Work in the Kirthar block is conducted jointly with Pakistan Petroleum Ltd., with production and expenses shared in proportion to the parties’ interests in the licence: PGNiG (operator) – 70%, Pakistan Petroleum Ltd. – 30%.

In H1 2015, the drilling of the Rizq-1 borehole was completed and a fracking operation was carried out. The maximum gas-flow rate recorded during the testing of the well was 206.5 cubic metres per minute. In September, the construction of surface installations was completed enabling an increase in the production rate to 800 cubic metres/min. The Rizq-1 well discovered another unconventional gas accumulation comprising 4.5 bcm of tight gas. In order to utilise the potential of the new discovery, a joint development strategy for the Rehman and Rizq deposits was prepared, which in the first stage will involve the hook-up and start of production from Rizq-1 and the drilling of two further wells: Rehman-2 and Rehman-3 (scheduled to commence in H1 2016). In 2015, construction work was also carried out on a gas pipeline to connect Rizq-1 to the Rehman production facility. As part of further exploration and documentation work, work also began on a new 3D seismic survey. Furthermore, the Company continued production from the Rehman-1 and Hallel X-1 wells.

The production facility on the Rehman field, the first one operated by the Company abroad, was placed in service in November 2015.For the first time in its history, the Company carried out a complete project abroad – from obtaining a licence, through exploration and appraisal, to production launch. The facility construction is one of the stages leading to full development of the Rehman and Rizq fields.

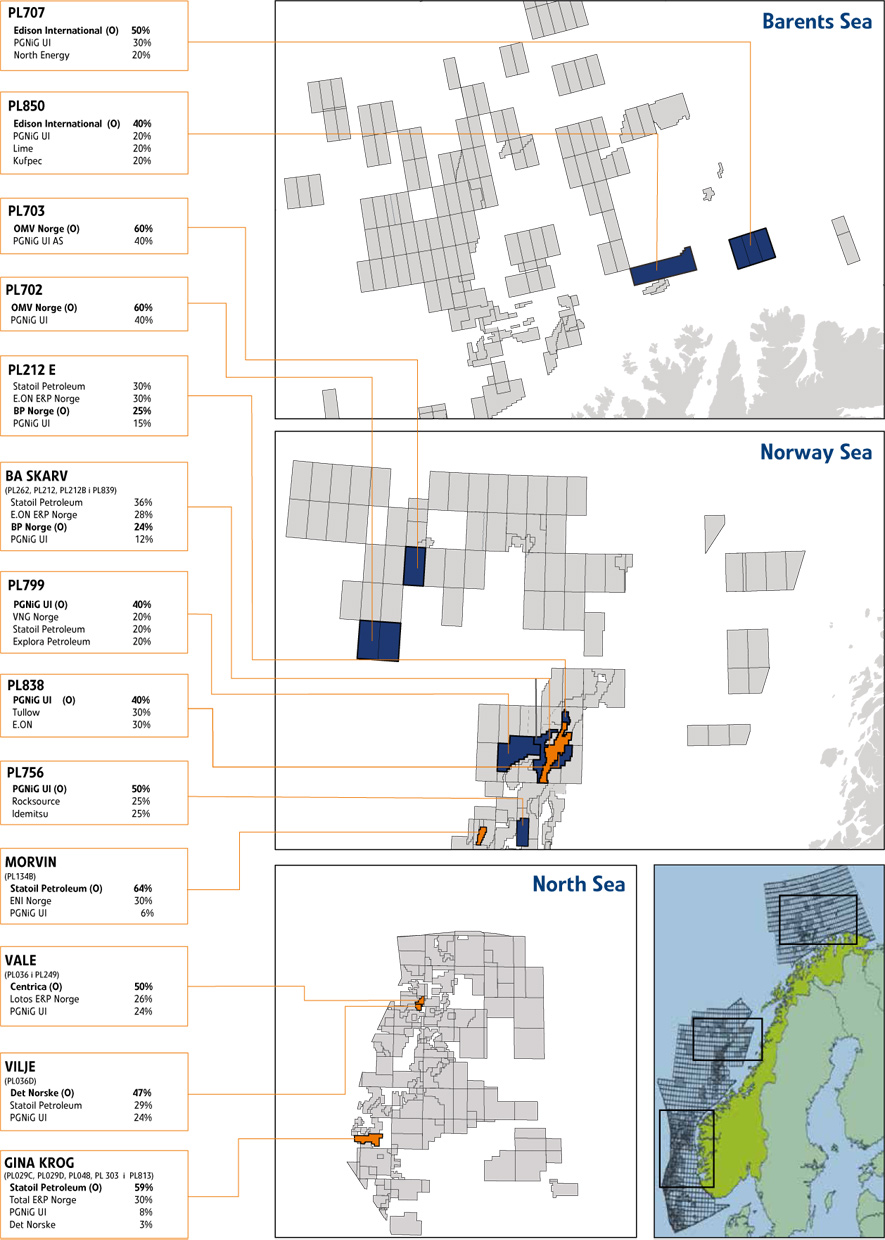

PGNiG Upstream International AS, a PGNiG Group company, holds interests in exploratory and production licences on the Norwegian Continental Shelf, in the North Sea, in the Norwegian Sea and in the Barents Sea. Jointly with partners, the company has been producing hydrocarbons from the Skarv, Morvin, Vilje and Vale fields and working on development of the Snadd and Gina Krog fields located on the Norwegian Sea and the North Sea. In the other licence areas, the company is engaged in exploration projects.

The company’s main asset is the Skarv field, which has been developed using a floating production, storage and offloading (FPSO) vessel. The FPSO is owned by the licence interest holders, including PGNiG Upstream International AS, and is expected to continue is operations for the next 20 years. Other producing fields (Morvin, Vilje and Vale) comprise a group of wells hooked up to the existing production infrastructure.

Based on research and analyses carried out in 2015, the field models were updated. As a result, the estimated recoverable reserves controlled by PGNiG UI increased significantly. The company’s total net reserves grew from 80.9 million boe at the end of 2014 to 87.3 million boe (5.1 thousand tonnes of crude oil and 6.6 million cubic metres of natural gas) at the end of 2015, although the production volume in 2015 reached 8.5 million boe.

In 2015, the company produced a total of 664 thousand tonnes of crude oil with condensate and NGL (measured as tonnes of crude oil equivalent) and 572.8 million cubic metres (i.e. 6.3 GWh) of natural gas from the Skarv, Morvin, Vilje and Vale fields. Production from all the fields was higher than initially planned. The increase was achieved primarily through the use on the Skarv field of a technique of injecting natural gas into a deposit to improve oil recovery.

Crude oil is sold directly from the fields to Shell International Trading and Shipping Company Ltd (crude from the Skarv, Vilje and Vale fields) and to Total Oil Trading (crude from the Morvin field). All the fields except for Vilje also produce associated gas, all of which is transferred via a gas pipeline to Germany, where it is collected by PGNiG Supply & Trading GmbH.

In 2015, PGNiG UI and its partners continued the development of the Gina Krog and Snadd fields as planned. Maersk, a new drilling rig placed in service in October 2015, is used to drill exploration and production wells on the Gina Krog field. A steel jacket was constructed over the Gina Krog field, on which a production platform will be placed. Most of the work to connect the Gina Krog field to the existing infrastructure was also carried out in 2015. Production from Gina Krog is scheduled to commence in 2017.

In 2015, as a partner in the PL029C licence area (in the vicinity of the Gina Krog field), the company was also involved in the drilling of an exploration well on the East-3 prospect. Data from the well confirm the presence of hydrocarbons.

In the case of the Snadd field, which is at the stage of selection of a development concept, work on selecting the optimum project scenario is under way. At the same time, a long-term production test is being carried out, which will help collect more detailed geological data to facilitate optimum development of the field.

In 2015, the company prepared and filed licence applications as part of two licensing rounds: APA 2015 and the 23rd Licensing Round. In January 2016, the company was awarded (in the APA 2015 licensing round) interests in four exploration and production licences, including one operatorship. Two of the licences (PL838 and PL839) are located in the Norwegian Sea, one in the North Sea (PL813), and one in the Barents Sea (PL850). The 23rd Licensing Round will be resolved in 2016.

Upon conclusion of the APA 2015 licensing round (in January 2016), the complete portfolio of licences held by PGNiG UI was as follows:

| Skarv i Snadd | |

|---|---|

| PGNiG’s interest | 12% |

| Partners | BP (Operator 24%), Statoil (36%), EON (28%) |

| Reserves as at end of the year | 58,7 m boe (net for PGNiG) |

| 2015 output | 15,9 thousand boe (net for PGNiG) |

| Morvin | |

|---|---|

| PGNiG’s interest | 6% |

| Partners | Statoil (Operator 64%), Eni (30%) |

| Reserves as at end of the year | 3.0m boe (net for PGNiG) |

| 2015 output | 1.6 thousand boe (net for PGNiG) |

| Vale | |

|---|---|

| PGNiG’s interest | 24% |

| Partners | Centrica (Operator, 50%), Lotos (26%) |

| Reserves as at end of the year | 2.9m boe (net for PGNiG) |

| 2015 output | 2.6 thousand boe (net for PGNiG) |

| Vilje | |

|---|---|

| PGNiG’s interest | 24% |

| Partners | Det norske (Operator, 47%), Statoil (29%) |

| Reserves as at end of the year | 4.2m boe (net for PGNiG) |

| 2015 output | 3.3 thousand boe (net for PGNiG) |

| Gina Krog | |

|---|---|

| PGNiG’s interest | 8% |

| Partners | Statoil (Operator, 59%), Total (30%), Det Norske (3%) |

| Reserves as at end of the year | 18.5m boe (net for PGNiG) |

| 2015 output | Planned to be launched in 2017 |

In 2015, the PGNiG Group produced a total of 4.6 billion cubic metres of natural gas (high-methane gas equivalent), of which 4.0 billion cubic metres was produced from fields in Poland, and 624 million cubic metres from fields abroad. Production of crude oil with condensate and NGL reached 1,429 thousand tonnes of crude oil equivalent, of which 664 thousand tonnes came from the Norwegian Continental Shelf. The increase in production at the Norwegian Continental Shelf was a result of PGNiG UI’s acquisition in 2014 of interests in producing fields (Morvin, Vale and Vilje) and the use of a new production technique on the Skarv field.

Natural gas and crude oil in Poland is extracted by two PGNiG branches: the Zielona Góra Branch and the Sanok Branch. The Zielona Góra Branch produces crude oil and nitrogen-rich natural gas at 21 sites, including 12 gas production facilities, 6 oil and gas production facilities and 3 oil production facilities. The Sanok Branch produces high-methane and nitrogen-rich natural gas and crude oil at 36 sites, including 18 gas production facilities, 13 oil and gas production facilities and 5 oil production facilities.

In 2015, in the operating area of the PGNiG Sanok Branch, six wells were hooked up on producing fields, test production began from one well, and production from two new fields (Załęże and Białoboki) was launched. The total addition to production capacity was approximately 7 thousand cubic metres of gas per hour (high-methane gas equivalent).

In the operating area of the PGNiG Zielona Góra Branch, two gas wells and two oil wells were hooked up on producing fields and production from the new Grodzisk 26 field was commenced. The total addition to production capacity was approximately 4.3 thousand cubic metres of gas per hour (high-methane gas equivalent).

| Nitrogen-rich gas | GWh | mcm* |

|---|---|---|

| Daszewo (Ls) | 250 | 30 |

| Bonikowo (Lw) | 1 667 | 200 |

*in natural units

In 2015, the Exploration and Production segment used the working capacities of the Daszewo and Bonikowo nitrogenrich gas storage facilities. Storage capacities used for the purposes of production are not storage facilities within the meaning of the Polish Energy Law.