Foreign Licences

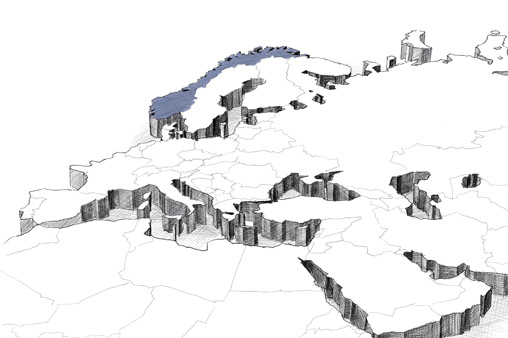

Norway

| Licences: | PL212, PL212B, PL212E, PL262 |

|---|---|

| Interest holders: | PGNiG Norway (11.9%) |

| BP Norge (23.8% – operator) | |

| Statoil Petroleum (36.2%) | |

| E.ON Ruhrgas Norge (28.1%) |

On the Norwegian Continental Shelf, PGNiG Norway and its partners are implementing the Skarv/Snadd/Idun development project. As at December 31st 2011, recoverable reserves in these licences were 60.1 bn m³ of natural gas, 16.5 m m³ of crude oil and condensate, and 7.9 m tonnes of NGL (that is 595 m barrels of crude and gas equivalent). PGNiG Norway holds an 11.9% interest in these reserves, that is the right to produce 70.9 m barrels of crude and gas equivalent.

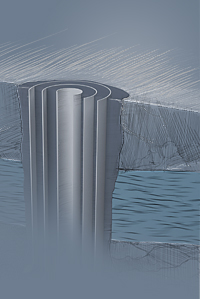

Production from the Skarv field will be carried out using a floating production, storage and offloading (FPSO) platform. The produced crude oil will be transported by a fleet of shuttle tankers, while natural gas will be transmitted over the undersea gas pipeline system to the European gas markets.

The Skarv project is one of the largest investment projects currently underway in Norway. Under the project, 17 wells will be drilled, including seven oil production wells, six gas production wells and four injectors. At a later stage of the reserve life, the injectors will be transformed into gas producers in order to fully exploit the reserve potential.

The Skarv FPSO platform, built in South Korea, is the largest FPSO vessel in the world, able to operate in rough weather conditions. The hull is 292 m long and 52 m wide. The vessel’s capacity is 140 thousand m³ (880 thousand barrels). The expected load capacity of the shuttle tankers operating on the Skarv field will be approximately 135 thousand m³ (850 thousand barrels).

In Q1 2011, the Skarv FPSO vessel was towed from South Korea to Norway. In August 2011, it was anchored in high sea, just above the Skarv field. Assembly of all submarine structures (foundation slabs, pipelines, etc.) on the Skarv and Idun fields was also completed in 2011.

The production of crude and gas from the Scarv field will be launched in 2012.

| Licences: | PL350 and PL 350B |

|---|---|

| Interest holders: | PGNiG Norway (30%) |

| E.ON Ruhrgas Norge (40% – operator) | |

| Statoil Petroleum (30%) |

The licence is located approximately 10 kilometres off the Skarv and Idun fields. In 2009 and 2010, the licence acreage was covered by seismic surveys, as well as geological and geophysical analyses and interpretations. Further, following the APA 2011 licensing round, a supplementary PL 350B licence area was acquired, covering the other prospects within the PL350 licence area.

The first exploratory well was drilled on the licence towards the end of 2011. The logging fully confirmed the geological assumptions, the drill having penetrated Permian formations, which had not been explored earlier. The well revealed the presence of hot shales and dolomite layers. The exploratory well also revealed adverse reservoir conditions in the rock. Further work is currently underway, comprising a detailed analysis of log data and assessment of the exploratory potential of the licence.

| Licence: | PL521 |

|---|---|

| Interest holders: | PGNiG Norway (35%) |

Statoil (40% – operator) |

|

| Svenska Petroleum Exploration Norge (25%) |

The licence was awarded in the 20th licensing round. In 2010, 3D seismic surveys were completed. In 2011, the acquired seismic data was interpreted. A decision whether to drill an exploration well is due in 2012. Statoil is the operator of the licence.

| Licence: | PL558 |

|---|---|

| Interest holders: | PGNiG Norway (30%) |

| E.ON Ruhrgas Norge (30% – operator) | |

| Det norske oljeselskap (20%) | |

| Petoro (20%) |

The licence, awarded in the APA 2009 licensing round in early 2010, is located in the immediate vicinity of the Skarv field, adjacent to the PL350 licence, which had been acquired earlier. The proximity of the Skarv FPSO platform may secure profitable exports of the crude oil and natural gas produced within the PL558 licence area.

Since the award of the licence, reprocessing and interpretation of the 3D seismic profiles has been performed, as have additional geological studies, which confirmed the potential of the area. The licence has a large exploratory potential, with probable discovery of crude oil and natural gas. At the beginning of 2012, the interest holders of the licence resolved to drill an exploratory well.

The licence is operated by E.ON Ruhrgas Norge.

| Licence: | PL599 |

|---|---|

| Interest: | PGNiG Norway (20%) |

| BG Norge AS (40% – operator) | |

| Idemitsu Petroleum Norge AS (20%) | |

| Norwegian Energy Company ASA (20%) |

| Licence: | PL600 |

|---|---|

| Interest holders: | PGNiG Norway (30%) |

| Dana Petroleum Norway AS | |

| (70% – operator) |

PGNiG Norway was awarded the PL599 and PL600 licences by the Norwegian Ministry of Hydrocarbons and Energy in April 2011, following conclusion of the first licensing round. Both licences are located in the Vøring basin, in the western part of the Norwegian Sea.

Under the licences, PGNiG Norway and its partners committed to reprocess the existing 3D seismic profiles and perform geological and geophysical surveys to evaluate the need for new geophysical data and – within two years – make a drill or drop (relinquishment) decision. If a decision to drill is made, the interest holders will drill a well within four years of the award date.

| Licence: | PL646 |

|---|---|

| Interest: | PGNiG Norway (20%) |

| Wintershall Norge (40% – operator) | |

| Lundin Norway (20%) | |

| Norwegian Energy Company (Noreco – 20%) |

| Licence: | PL648S |

|---|---|

| Interest: | PGNiG Norway (50% – operator) |

| OMV Norge (50%) |

At the beginning of 2012, PGNiG Norway acquired interests in licences PL646 and PL648S in the Norwegian Sea. The areas of both licences are adjacent to the Skarv field, which is in line with the company’s strategy. PGNiG Norway focuses its operations on key areas, such as the Skarv field, where it builds its position.

On the licences held, PGNiG Norway and its partners undertook to reprocess the existing seismic data or purchase 3D seismic profiles. The partners will also carry out geological and geophysical analyses in order to determine whether new geophysical data should be collected. Within two years, the interest holders of the licence have to make a drill or drop (relinquishment) decision. If a decision to drill is made, the interest holders should drill a well within four years of the award date.

The PL 648S licence is of special importance: it is the first time ever that PGNiG has assumed a highly responsible role of an operator on the Norwegian Continental Shelf. Having been granted the status of licence operator marks an important step in the development of the PGNiG Group. For us, this is the first operatorship of a project of offshore exploration for crude oil and gas; it emphasises PGNiG Norway’s role as the PGNiG Group’s competence centre for offshore operations.

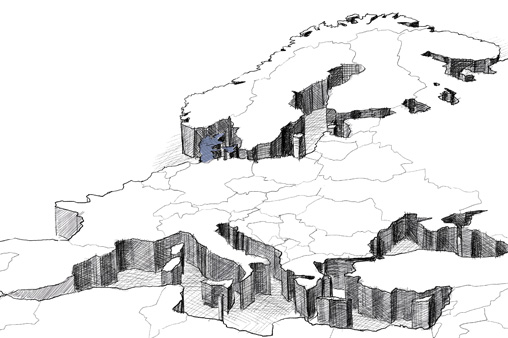

Denmark

| Licence: | 1/05 |

|---|---|

| Interest holders: | PGNiG (80%) |

| Nordsofonden (20%) |

Since the execution of the agreement on assignment of interests in 2007, PGNiG has been engaged in exploration activity in the 1/05 licence area in Denmark. Drilling of the Felsted-1 exploration well started in 2011. Following well logging performed at the beginning of 2012, no commercial hydrocarbon flow was identified, and the well was abandoned. Given the negative results from the exploration well, PGNiG decided not to extend the 1/05 licence in Denmark.

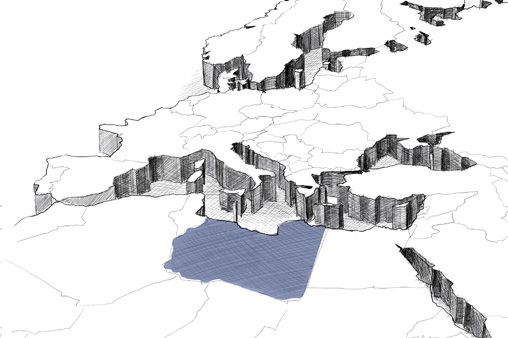

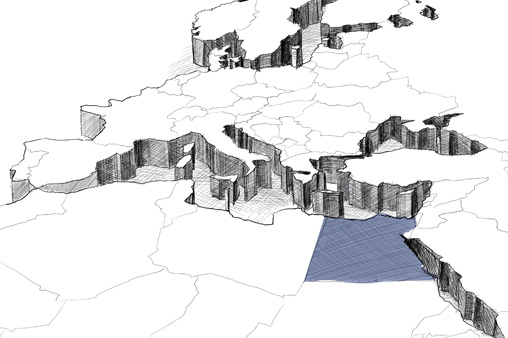

Libya

| Licence: | Block No. 113 |

|---|---|

| Interest: | PGNiG (100%) |

In February 2008, a PGNiG Group company, POGC Libya, signed an Exploration and Production Sharing Agreement (EPSA), enabling the company to carry out exploration work on Exploratory and Production Licence No. 113 with an area of 5.5 thousand km². The licence is located in the Murzuq crude oil basin in western Libya.

In 2011, the National Oil Corporation gave its consents (including one conditional consent) to the company’s drilling of two exploratory wells within the licence area. The company has also submitted two further drilling projects for approval by the National Oil Corporation. By February 2011, the company acquired 3,000 km of 2D profiles and 1,087 km² of 3D profiles, and carried out a number of geological analyses. Preparations for the drilling are underway.

When the civil war in Libya broke out in February 2011, all non-Libyan personnel of POGC Libya were evacuated from the country. In March 2011, the company gave notice to the National Oil Corporation of a force majeure event, which suspended performance of the Exploration and Production Sharing Agreement until the situation, which provided the basis for such notice, ceases to apply. In October 2011, the civil war in Libya ended and the company resumed the operation of the office for local employees.

In 2011 in Poland, in cooperation with PGNiG, the company completed the geological interpretation of 2D seismic data and planned data acquisition for the remaining second phase of the 3D survey.

In 2012, POGC Libya plans to bring expatriates back to Libya, and when the situation is stable enough to ensure the employees’ personal safety, the company will resume its work under the EPSA agreement.

Egypt

| Licence: | Bahariya |

|---|---|

| Interest holders: | PGNiG (100%) |

In Egypt, PGNiG has been conducting exploration work in the Bahariya licence area (Block 3) under an Exploration and Production Sharing Agreement (EPSA) executed with the government of Egypt on May 17th 2009. PGNiG holds a 100% interest in the licence. Due to the unstablepolitical situation in Egypt, at the beginning of 2011 Polish employees of the PGNiG EgyptBranch were temporarily withdrawn from the country, which however did not affect the progress ofthe exploration work. In 2011, field gravimetric surveys and their interpretation were completed. Theplanned acquisition of 1,600 km of 2D profiles commenced, of which 516 km were acquired in 2011. Protracting administrative procedures concerning tender approval delayed acquisition of the restof the 2D seismic data until the following year. Processing of seismic data and drilling work arescheduled for 2012.

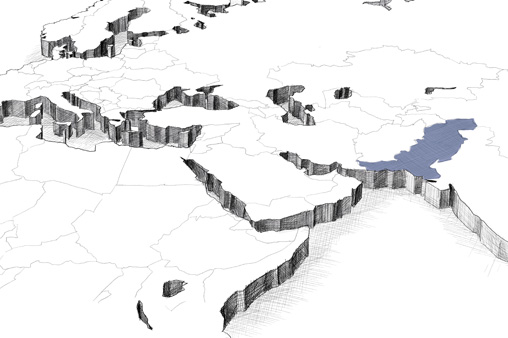

Pakistan

| Licence: | Kirthar |

|---|---|

| Interest holders: | PGNiG (70%) |

| Pakistan Petroleum Limited (30%) |

PGNiG conducts exploration work in Pakistan under an agreement on hydrocarbon exploration and production in the Kirthar licence area executed between PGNiG and the government of Pakistan on May 18th 2005. Work in the Kirthar block is conducted jointly with Pakistan Petroleum Ltd. In 2011, work was underway on workover of the Hallel-1 borehole. Also, processing and interpretation of 2D and 3D seismic data were completed. Results of the interpretation confirmed the presence of a structure giving rise to accumulation of hydrocarbons (Rehman field). In 2012 the construction of surface installations and connection to the receiving system, necessary for test production are planned.