Risks

Regulatory Environment

In 2013, work was still underway on a set of three bills to regulate the energy sector: the Gas Law, the Energy Law and the Law on Renewable Energy Sources (the so-called ‘Big Energy Three-Pack’). On September 11th 2013, the Act Amending the Energy Law and certain other acts (the so-called ‘Mini Energy Three-Pack’) came into force. The amendment introduced changes to the regulatory regime governing the natural gas market, reflecting the need to bring Polish legislation in line with the provisions of the European Union’s Third Energy Package, and the need to deregulate the gas market particularly through the exchange sale obligation.

The requirement to sell gas through the exchange market, which has been imposed on the Company, is aimed to deregulate the Polish gas market, boosting competition. The mechanism improves the market’s transparency and allows market participants to purchase the product on equal terms. On the other hand, it may mean a steady loss of PGNiG’s market share. However, the actual rate of PGNiG’s market share decline will depend on the number and size of new players entering the gas market, and the price differentials between the OTC and exchange markets. While PGNiG is prepared to fulfil this statutory obligation in terms of supply, the low demand for gas on the exchange market may prevent it from actually meeting its statutory obligation in terms of sales. This is why the Group has taken steps to boost demand on the Polish Power Exchange.

Furthermore, the amendments to the Polish Energy Law mean that an end user may now terminate a gas fuel supply agreement without penalty or payment of any compensation other than that stipulated in the agreement. Given the costs of purchasing gas (including the cost of transmitting it to Poland and other transaction costs) and the security of supply, customers will seek to optimise their purchase portfolios by acquiring gas in or outside of the exchange market.

The Energy Efficiency Act came into force in August 2011, implementing Directive 2006/32/EC of the European Parliament and of the Council of April 5th 2006 on energy end-use efficiency and energy services. The Energy Efficiency Act establishes a national target for economical use of energy which stipulates that the minimum level of end-use energy savings by 2016 should be 9% of annual national energy consumption. Since January 1st 2013, PGNiG, as a trading company, has been obliged to purchase energy efficiency certificates or else pay the buy-out price. This obligation will drive up the cost of regulated activities and, consequently, inflate gas prices for customers.

In 2013, legislative work was underway on a fundamental change in the regulatory regime for the exploration and production segment, comprising two bills: the draft act to amend the Geological and Mining Law and certain other acts, and the draft Act on the Special Hydrocarbon Tax. There is also work in progress to amend the Act on the Tax on Production of Certain Minerals and other acts besides it. The draft acts provide for an increase in the fiscal burden on the production of minerals and for a change to the existing licensing system. In future, these amendments will adversely affect PGNiG’s profitability.

Tariff calculation

PGNiG’s ability to cover the costs of its core operating activities depends on the prices and rates approved by the President of the Energy Regulatory Office. In approving tariffs for a given period, the President of the Energy Regulatory Office considers other factors external to and beyond the control of the PGNiG Group. Moreover, the President of the Office does not always accept the assumptions adopted by PGNiG on the major factors influencing its costs and profit targets which take into account business risks. Lower tariff prices and charges may adversely affect PGNiG’s profitability. Profitability may also be impacted by the effective terms of tariffs, which are often extended by the President of the Energy Regulatory Office, and by protracted tariff approval proceedings.

Purchase prices of imported gas

Prices of imported gas are denominated in USD or EUR and are based on indexation formulae reflecting the prices of petroleum products and/or gas on the liquid market of Western Europe. Accordingly, changes in foreign exchange rates or prices of petroleum products and gas materially affect the cost of imported gas. Any accurate forecast of natural gas price developments carries a high risk of error. Approved prices can be legally adjusted during a tariff term. However, there is a risk that an increase in the price of imported gas may not be fully passed on to customers or that changes in gas sale prices may lag behind changes in gas import prices.

Take-or-pay import contracts

PGNiG is a party to four long-term take-or-pay contracts for gas fuel deliveries to Poland, of which the most important are contracts with Gazprom Eksport and Qatargas Operating Company Ltd. Assuming that PGNiG’s customer portfolio remains unchanged, the volume of gas imports specified in the take-or-pay contracts will limit its purchases of spot gas, currently the most attractively priced. If PGNiG loses its market share, there is a risk that the Company will need to seek new opportunities to sell or utilise surplus gas to avoid payment of penalties for the uncollected quantities under the take-or-pay contracts, or to sell the surplus with a negative margin. There is also a risk that if Polskie LNG SA fails to put the LNG Terminal in operation by December 31st 2014, PGNiG will incur penalties for uncollected quantities of liquefied natural gas, as stipulated in the take-or-pay contract with Qatargas Operating Company Ltd. Another risk is that, under the existing contract terms and market conditions, the tariffs approved by the President of the Energy Regulatory Office will not cover PGNiG’s weighted average cost of gas acquisition.

Obligation to diversify imported gas supplies

The maximum share of total gas importable from one country in a given year is determined in the Council of Ministers’ Regulation of October 24th 2000 on the minimum level of diversification of foreign sources of gas supplies. In 2012, the President of the Energy Regulatory Office instigated administrative proceedings to impose a fine on PGNiG for its failure to comply with the obligation to diversify supplies of imported gas in 2010 and 2011 – on May 11th and December 5th, respectively. Similar administrative proceedings were instituted by the President of the Energy Regulatory Office concerning PGNiG’s failure to comply with the obligation to diversify supplies of imported gas in 2007, 2008 and 2009. The 2009, 2010 and 2011 proceedings were suspended ex officio until the conclusion of the 2007 and 2008 proceedings, held before the Court of Competition and Consumer Protection.

In 2011 PGNiG submitted an inquiry to the Constitutional Court concerning compliance of the Council of Ministers’ Regulation of October 24th 2000 on the minimum level of diversification of foreign sources of gas supplies with the Polish Constitution.

If the Regulation is not amended, the President of the Energy Regulatory Office may continue imposing fines on the Company for failing to comply with the diversification requirement until gas starts to be supplied from other sources (e.g. through the LNG terminal).

Resource discoveries and estimates

The main risk inherent in exploration activities is the risk of failure to discover resources, i.e. the exploration risk. This means that not all identified leads and prospects actually have deposits of hydrocarbons which can qualify as an accumulation.

The reserves estimates and production projections may be erroneous due to imperfections inherent in the equipment and technology, which affect the quality of acquired information concerning the geological factors and reservoir characteristics. Irrespective of the methods applied, data on the volume and quality of commercial reserves of crude oil and natural gas are always estimates. Actual production, income and expenses relating to a given deposit may significantly differ from such estimates. The weight of this risk is further increased by the fact that in the full business cycle the period from the commencement of exploration to the launch of production from a developed field takes six to eight years, while the production phase lasts from 10 to 40 years. Formation characteristics defined at the stage of reserves determination are reviewed after production starts. Each downward revision of the size of reserves or estimated production quantities may lead to lower-than-expected revenue and adversely affect the PGNiG Group’s financial performance.

A risk associated with exploration for unconventional gas in Poland relates to the lack of proved reserves of shale gas and tight gas. Even if the existence of in-place petroleum is confirmed, its production may prove uneconomic due to poor gas recovery and high investment expenditure necessary for well drilling and construction of production infrastructure. Another material factor is that access to unconventional gas plays may sometimes be difficult given the environmental regulations and the necessity to obtain the landowners’ consent for access.

Competition in exploration

Both on the Polish market and abroad there is a risk of competition from other companies in the acquisition of licences for exploration and appraisal of hydrocarbon deposits. Certain competitors of the PGNiG Group, especially global majors, enjoy strong market positions. They are likely to bid for and be able to acquire highly prospective licences.

Delays in upstream projects

Under the applicable Polish legal regulations, the process of obtaining a licence for exploration and appraisal of crude oil and natural gas deposits lasts from one to one and a half years. On foreign markets, such procedures may even take up to two years from the time that the winning bid is awarded until the relevant contract is ratified. Prior to the commencement of field work, the Company is also required to make a number of arrangements, for instance to obtain legal permits and approvals for entering the area, and to meet the environmental protection requirements and, in some cases, requirements related to the protection of archaeological sites. It is also required to hold tenders to select a contractor. All this delays the execution of an agreement with a contractor by another few months. Frequently, the waiting time for customs clearance of imported equipment is very long. These factors create a risk of delay in the start of exploration work.

Cost of exploration

Exploratory work is very capital intensive, given the prices of energy and materials. The cost of exploratory work is especially sensitive to steel prices, which are passed onto the prices of casing and production tubing used in well completion. An increase in the prices of energy and materials drives up the cost of exploratory work. Moreover, the profitability of foreign exploration projects depends to a significant extent on the prices of oil derivative products and on currency exchange rates. To reduce the cost of drilling operations, in 2011 PGNiG introduced a daily rate system into its drilling contractors selection procedure.

Hydrocarbon deposits developed by PGNiG are often at great depths, which involves extremely high pressures and, in many cases, the presence of hydrogen sulfide. Consequently, the risk of hydrocarbon blowout or leakage is very high, which in turn may pose a threat to people (workers and local populations), the natural environment and production equipment.

The need to ensure compliance with environmental laws in Poland and abroad may significantly increase the PGNiG Group’s operating expenses. Currently, the PGNiG Group incurs significant expenditure to meet the applicable health, safety and environmental protection regulations.

Political and economic situation

The PGNiG Group’s exploration sites are located in countries threatened by armed conflicts, social or political unrest, and terrorist activity.

In February 2011, PGNiG evacuated all the non-Libyan employees of POGC – Libya BV following a force majeure event. The company’s operations were resumed in the second half of 2012. A similar situation took place in January 2014, when all Polish staff of PGNiG working on the Murzuq 113 licence were evacuated back to Poland. The site was sealed and secured by Libyan government forces and was left to be overseen by local subcontractors.

In certain countries, the lack of adequate infrastructure may be an obstacle in transporting equipment, personnel and materials to the sites. Problems may also arise in providing supplies and appropriate health care. These factors may lead to limitation, suspension or discontinuation of the Company’s exploration and production activities.

Competition in gas sale

PGNiG is the largest supplier of natural gas in Poland. However, the upcoming gas market deregulation is bound to trigger major changes in the market itself and the related legal framework. In 2012, a natural gas market was launched on the Polish Power Exchange. Under a decision issued by the President of the Energy Regulatory Office, trade in natural gas carried out by PGNiG on the exchange market is exempt from the tariff obligation. In 2012, PGNiG also started work on the liberalisation of gas prices for customers. This will be a phased process, with gas prices for large industrial customers to be liberalised first.

As a result of the expected changes, the Company’s share in total sales of natural gas sales may fall, to the benefit of both existing players and new entrants.

Increase in the volume of mandatory stocks

Pursuant to the Act on Stocks of Crude Oil, Petroleum Products and Natural Gas, mandatory reserves must be maintained at a volume of 30 days’ average annual imports, and must be kept in storage facilities which can ensure their delivery in full to the gas system within a 40-day period. Meeting these statutory requirements exposes PGNiG to financial and technological risks, and endangers the fulfilment of its contractual obligations.

Given the technical specifications required by law for delivery of mandatory gas stocks to the system, a significant portion of these stocks had to be placed in the Mogilno underground gas storage cavern, which is a peak-demand storage facility. As a result, the mandatory stocks significantly limit the commercial use of the site’s storage capacity and deliverability. As mandatory gas stocks may be withdrawn only with the consent of the Minister of Economy and only after gas supply limits have been introduced, the Company may fail to ensure the continuity of gas supplies to end users.

Another consequence of maintaining mandatory stocks is that the storage capacities remain partially filled after the winter season is over, which reduces the injection capacities in summer. Injection of gas into storage during the summer season, when demand for gas is low, enables the Company to meet the summer minimum volume to be imported under the Yamal contract, as it increases total demand for natural gas. Consequently, PGNiG may not be able to meet its contractual obligations concerning offtake of imported gas if the gas volumes in storage are high at the beginning of summer.

Competition in gas distribution

Liberalisation of the gas market is contributing to intensified competition faced by the PGNiG Group’s distribution segment. Other companies distributing natural gas are progressively expanding their gas networks and attracting new customers. Additionally, new players have emerged, offering LNG distribution services. The barriers to market entry are definitely lower here, as LNG distribution involves significantly lower capital expenditure and does not require a connection to the gas system or adequate reserve capacity to be maintained in the transmission and distribution networks.

Another issue which affects our gas distribution company’s competitive position is the tariff policy of the Energy Regulatory Office, which makes it difficult to operate a flexible pricing policy for some groups of customers. With the lack of flexible pricing, the competitors’ offers may prove an attractive alternative for existing customers of the PGNiG Group’s distribution segment.

Sources of gas supply for the distribution system

Polska Spółka Gazownictwa Sp. z o.o.’s distribution network is connected to the transmission system operated by OGP GAZ-SYSTEM SA, which is its main source of gas supplies. The transmission system’s limited capacity in terms of the volume and pressure of supplied gas hinders or prevents further development of the gas grid within the company’s key areas of operation.

Transmission easement

More and more frequently, the PGNiG Group is facing excessive financial claims raised by owners of land where the gas network was developed in the past. Transmission easement serves as a basis for determining the extent to which a transmission company can use third-party property, for which relevant consideration is due to the owner. The owners’ claims give rise to additional, frequently considerable costs, and thus may adversely affect the financial performance of the PGNiG Group’s distribution segment.

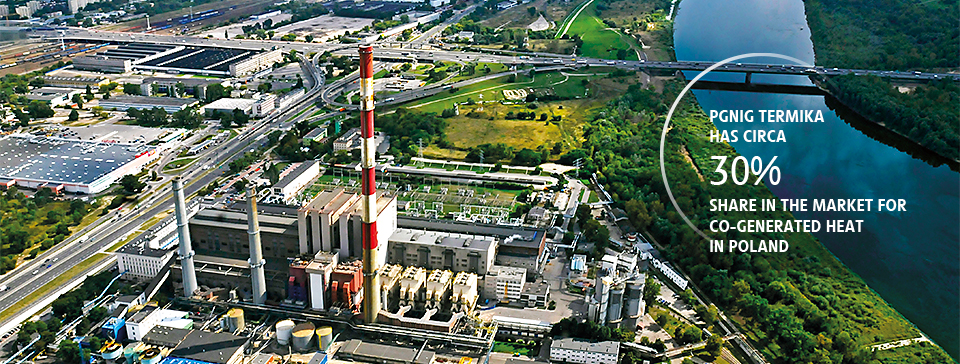

Electricity generation

The expiry of support mechanisms for gas- and coal-fired cogeneration is a material risk affecting the electricity and heat generation industry. There is also no transparent, long-term policy in place to support investments in renewable energy sources and cogeneration. These factors fundamentally affect PGNiG TERMIKA’s development decisions and create a significant risk of deterioration of the company financial standing.

Moreover, at current price levels, the expiry of the support system for electricity and heat produced in high efficiency cogeneration, based on the so-called yellow certificates, makes generation of heat and electricity from natural gas unprofitable, which results in lower demand for gas from some CHP plants.

Furthermore, in order to meet more stringent gas and dust emission standards to be implemented in 2016, producers have to modernise their power and CHP plants and may be forced to shut down a number of generating units (a total of some 4,000 to 6,000 MWe by 2020) where it is not economically viable to install expensive flue gas treatment systems. In order to meet the more stringent emission standards, PGNiG TERMIKA has gradually been modernising its generation assets.

Maintaining share in the municipal heat market

As the Warsaw municipal waste incineration plant is expanded, the quantity of heat supplied to the city’s municipal network will increase. As a result, PGNiG Termika’s share in total heat supplies to the municipal network covering the Warsaw area will fall from the current 98% to 95% in 2019.

Joint marketing efforts with Dalkia Warszawa SA and connection of further areas of western Warsaw to the municipal heating network should significantly mitigate a potential future decline in the volume of energy produced at PGNiG Termika’s generation plants. With a view to maintaining its share in the municipal heat market, the company also offers ‘green’ heat generated in biomass-fired units, continues to sell energy at competitive prices, and takes advantage of the TPA rule to gain access to new end users.