Distribution

Through six regional gas distribution companies, natural gas is supplied to households as well as to small and medium-sized enterprises. In 2012, 9.9 billion cubic meters of natural gas were distributed through the gas distribution network. The reliability and stability of supplies made via this network is attested to by the growing number of connections, including with such major players as Grupa LOTOS SA.

Key Events

- The “Short-term Value Creation Strategy for the PGNiG Group in 2012–2014”, adopted in December 2012, sets the consolidation of the Gas Distribution Companies as one of its goals.

- The volume of distributed gas in 2012 was 9.9 bn m³ , up by almost 0.8 bn m³ on 2011.

The segment’s core business consists in the transmission of high-methane and nitrogen-rich gas, as well as of small amounts of propane-butane and coke-oven gas over the distribution network. Natural gas distribution is the business of the six Gas Distribution Companies, which supply gas to households, as well as to industrial and wholesale customers. These entities are also responsible for operation, maintenance and expansion of the distribution network. Based on a decision of the President of the Energy Regulatory Office, since mid-2007 the Gas Distribution Companies have had the status of Distribution System Operators.

Financial Performance in 2012

The Distribution Segment derives revenue from transmission of natural gas via the distribution network. Gas distribution tariffs are determined by the Energy Regulatory Office. The revenue of the six Gas Distribution Companies is subject to seasonal fluctuations throughout the year. The largest gas volumes are transmitted via the distribution network in winter (Q1 and Q4 of each year).

The 2012 operating profit of the Distribution segment expanded by 12% year on year, to PLN 878 m. This significant improvement was achieved thanks to a 5% increase in the volume of distributed gas and an average 1.7% increase in distribution tariffs in July 2011. The volume of distributed gas increased on the back of higher gas consumption by households and smaller industrial plants, connected to the distribution network, which in turn followed from lower air temperatures in Q1 and Q4 compared with the corresponding periods of 2011, as well as from acquisition of new customers, including for coking gas distribution.

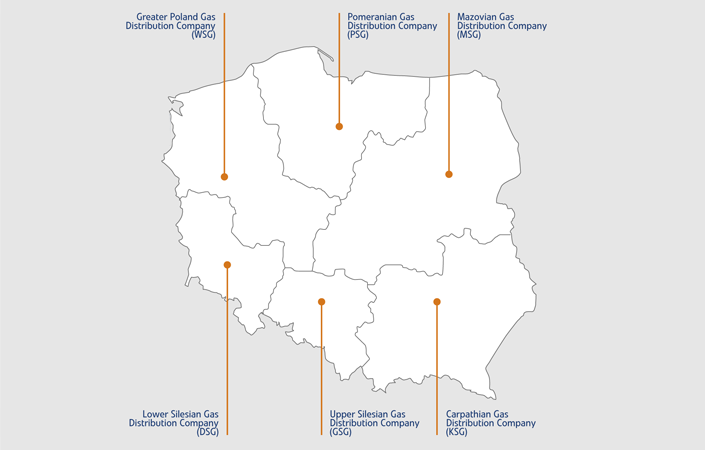

Gas Distribution Companies in Poland

Tariff Policy

The regional gas distribution companies forming part of the PGNiG Group have the status of Distribution System Operators. Until mid-2007, the distribution companies of the PGNiG Group were involved in both trade in and distribution of gas. In accordance with the requirements of the Polish Energy Law, which implemented the requirements of EU Directive No. 2003/55/EC, in 2007 PGNiG performed a legal separation of the distribution and trade businesses. As a consequence, in mid-2007 the Distribution System Operators were spun off (currently: Gas Distribution Companies). Since Q4 2007, the entire trade business, including retail sales and wholesale, has been integrated into PGNiG.

Gas distribution activities require license, similarly to trading in gas fuel. This means that the Gas Distribution Companies must seek the approval of the Energy Regulatory Office with regard to rates for gas fuel distribution. The tariffs set forth:

- charge rates for the distribution services and subscription fees;

- the formula for determining fees for connecting customers to the high-, medium- and low-pressure networks.

Moreover, the tariffs define the manner of determining the charges for exceeding the contractual capacity, penalties for illegal abstraction of gas fuels and failure to comply with the imposed limitations, as well as of price reductions for failure to maintain quality standards in customer service.

In connection with the ongoing process aimed to develop a new model for the Polish gas market, on July 24th 2012 the President of the Energy Regulatory Office approved the Transmission Grid Code for the Polish transmission system owned by OGP Gaz-System SA. Based on the newly approved Code, distribution system operators must purchase transmission services at the exit points of the transmission system, which are also the entry points to the distribution system. As a result, the tariffs for gas distribution by the six operators of the distribution systems owned by the PGNiG Group, approved by the President of the Energy Regulatory Office on December 17th 2012, were calculated based on the operating costs planned for the effective period of the tariff, including the cost of purchase of transmission services at the exit points from the transmission system, which are at the same time the entry points to the distribution system.

Gas Fuel Distribution

In 2012, the Gas Distribution Companies transmitted 9.9 bn m³ of natural gas (measured as high-methane gas equivalent) via the distribution system. The amount exceeds the level recorded a year earlier (9.1 bn m³) by 0.8 bn m³, or 9%. As at the end of 2012, the net length of the distribution network (excluding connections) was 120.8 ths km. The six Gas Distribution Companies provide services to approximately 6.7 m customers.

Gas Fuel Distribution

| DSG | GSG | KSG | MSG | PSG | WSG | Total | |

|---|---|---|---|---|---|---|---|

| No. of customers (millions) | 0.75 | 1.3 | 1.46 | 1.52 | 0.74 | 0.93 | 6.7 |

| Volume of distributed gas (bn m³) | 1 | 2 | 2 | 2.1 | 1.2 | 1.6 | 9.9 |

| Network length, excluding connections (ths km) | 7.98 | 21.22 | 45.4 | 19.65 | 10.27 | 16.27 | 120.79 |

Capex Projects

The capital expenditure incurred in 2012 in the Distribution Segment amounted to PLN 1.14 bn. The capex budgets of the Gas Distribution Companies were spent on upgrading and expanding the gas network as well as connection of new customers. The segment’s development projects accounted for approximately 65% of the total capital expenditure.